T&E Management Challenges for Growing Businesses and How to Overcome Them

Global business travel is entering a renewed growth phase, with spending is steadily rising across regions - prompting companies to rethink how they manage budgets, approve trips, and measure ROI. According to the latest GBTA report, one trend is clear - traditional manual processes can’t keep pace with today’s expectations for visibility, control, and efficiency.

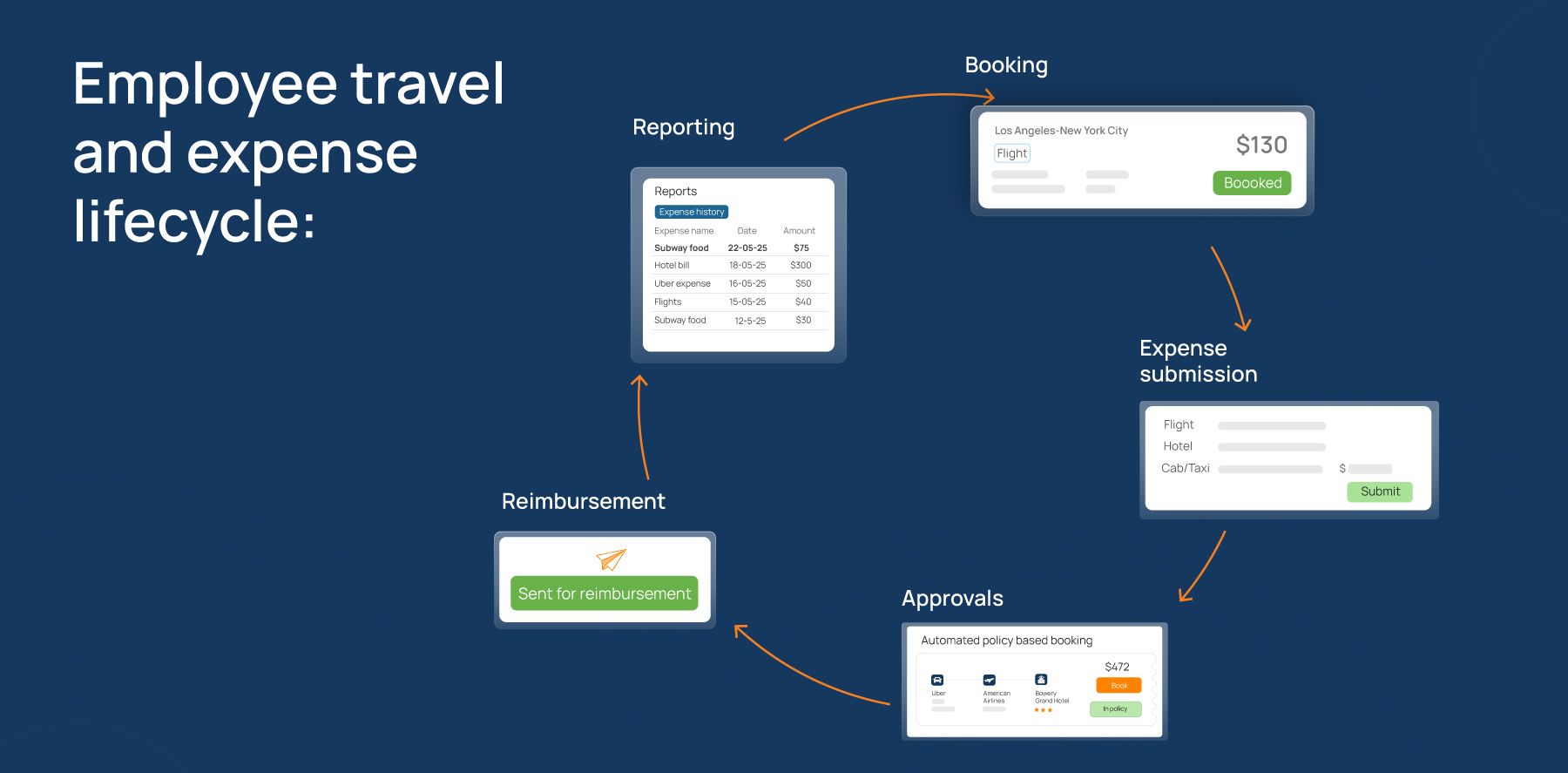

As companies expand, even small increases in employee travel introduce new layers of complexity - more bookings to manage, more invoices to validate, more policies to enforce, and far more data to reconcile. What once felt manageable through spreadsheets and email approvals quickly becomes time-consuming, error-prone, and difficult to control. Growing businesses often face inconsistent spending, delayed reimbursements, compliance risks, and limited visibility into total travel costs. These issues emerge gradually but can significantly impact cash flow, employee experience, and financial accuracy over time.

Challenge 1: Manual Expense Tracking Takes Too Much Time

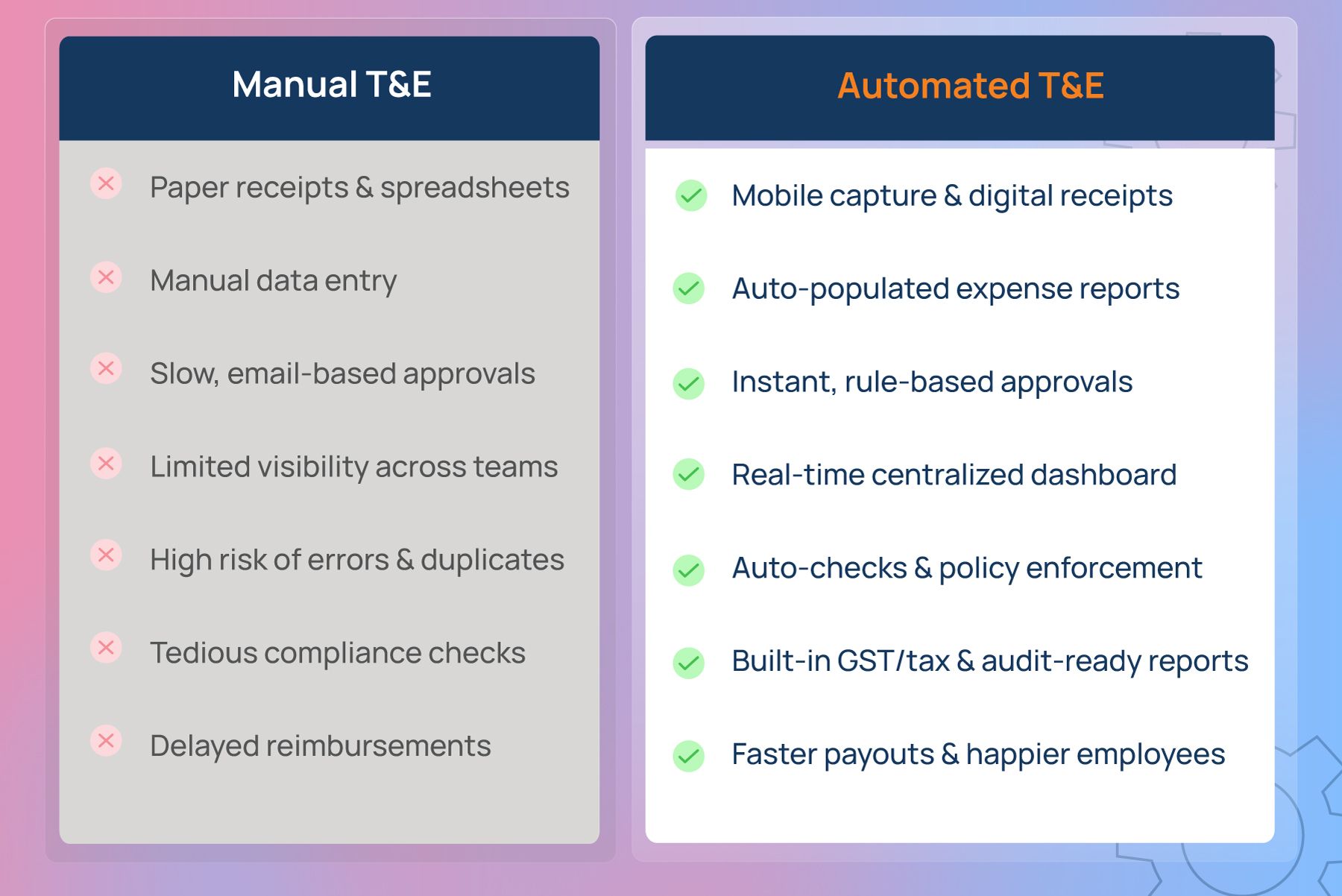

Many companies begin with paper receipts, Excel sheets, and emails. While this works for small teams, it becomes a bottleneck as travel volume grows. Finance teams spend hours cross-checking receipts, validating fields, chasing missing claims, and fixing errors.

Beyond wasted time, manual processes also lead to frequent mistakes. Nearly half of finance professionals consider manual data entry their biggest pain point as every claim needs to be entered, verified, and corrected manually, making reimbursements slow down and accounting accuracy suffer.

Automation changes this entirely. Smart tools can read receipts, auto-fill details, categorize expenses, and even check them against policy, saving hours every week and improving accuracy.

Challenge 2: Lack of Clear Travel Policies

A common issue in fast-growing companies is that travel rules do not evolve at the same pace as the business. Teams scale rapidly, travel increases, but the company still depends on informal guidelines such as ‘book reasonably’ or ‘check with your manager.

This leads to inconsistent spending, last-minute bookings, and misunderstandings around what is reimbursable. Growing businesses need travel and expense policies that are simple, accessible, and easy to enforce. These should outline booking timelines, preferred channels, expense limits, and approval workflows. A clear policy ensures fairness and reduces unnecessary back-and-forth between employees and finance teams.

Challenge 3: Missing Visibility on Travel Spend

As more employees book their own travel, often on multiple apps or websites, finance teams lose visibility. They receive claims only after the trip is completed, which means they have no real-time view of spending patterns or budget deviations. This lack of visibility makes it difficult to forecast budgets, plan cash flow, identify duplicate or fraudulent claims, and negotiate better vendor rates.

A Deloitte Corporate Travel study notes that decentralized booking environments are one of the top barriers to cost optimization. Centralizing travel bookings through one system helps companies see the full picture and make faster financial decisions.

Challenge 4: Slow Reimbursements and Employee Frustration

Growing companies often face approval bottlenecks. Managers may miss emails, receipts may be incomplete, or finance teams may be overwhelmed. These delays impact the employee experience directly - when reimbursements take too long, trust in the system drops, leading to late submissions and lower compliance. Automated workflows speed up approvals, ensure policy compliance upfront, and route claims instantly, creating a faster, smoother reimbursement process.

Challenge 5: Compliance and Audit Issues

As businesses grow, compliance with tax regulations, internal controls, and audit requirements becomes increasingly complex. Missing tax numbers, incorrect invoices, or unverified claims can quickly create gaps that lead to audit risks. According to the PwC Global Compliance Study 2025, 77% of organizations reported being negatively impacted by increased compliance complexity, highlighting how rapidly evolving regulations and fragmented processes can create exposure for growing businesses.

Without the right systems in place, these issues often surface only during audits, when correcting errors can be costly and time-consuming. Automated checks within T&E tools, such as validating invoices, matching receipts, and flagging anomalies, allow finance teams to detect potential compliance issues early. This proactive approach not only reduces the risk of penalties but also ensures a smoother audit process and more accurate reporting.

Challenge 6: Data Spread Across Different Tools

A common problem for scaling businesses is that bookings, approvals, expense tracking, and reimbursements happen on different platforms. Finance teams must switch between systems, reconcile manually, and chase missing data. This fragmentation causes inaccurate reporting, delayed month-end closing, confusing workflows for employees, and high administrative workload.

A unified T&E platform connects bookings, expenses, reimbursement workflows, and accounting, ensuring that all data stay consistent and easy to manage.

How to Overcome These Challenges

Growing companies can build a scalable, efficient T&E process by focusing on a few core strategies:

1. Automate Routine T&E Tasks: Automation reduces manual entry, speeds up workflows, and ensures accuracy. Receipt scanning, auto-categorization, OCR-based data extraction, and automated policy checks minimize human error and save time. With fewer manual touchpoints, finance teams can focus on strategic analysis rather than administrative tasks.

2. Establish Clear and Accessible Travel Policies: Policies should be easy to understand and apply. Define booking channels, spending limits, preferred vendors, required documentation, and approval hierarchies. Share the policy widely through onboarding, intranet, email, and your T&E platform, so employees know exactly what to do before and after travel.

3. Centralize All Travel Bookings and Expense Reporting: A unified system reduces the fragmentation that leads to hidden spending and inconsistent reporting. Centralization gives finance leaders the ability to track all travel in one place, compare costs, enforce policy automatically, and analyze trends with real-time dashboards.

4. Run Regular Expense Audits: Proactive audits help find duplicate claims, out-of-policy expenses, unnecessary add-ons, and vendor-related gaps. Monthly or quarterly reviews help plug revenue leaks early and improve financial discipline across departments.

5. Integrate T&E Tools with Accounting or ERP Systems: Integrations ensure that approved expenses flow directly into your ERP or accounting software. This eliminates reconciliation errors, speeds up closing cycles, and maintains a single source of truth for financial data.

6. Train Employees Frequently: Employees must know how to submit expenses correctly, attach valid receipts, follow approval flows, and comply with the latest policy. Short refresher sessions or in-app tutorials help reduce errors and maintain consistency.

Best Practices for Growing Businesses

To build a world-class T&E process, companies should adopt a few long-term best practices:

1. Set Clear Approval Workflows: Define who approves what - by department, spend limit, and type of travel. This avoids confusion, reduces delays, and ensures accountability.

2. Track Spending by Category: Monitoring spends across flights, hotels, meals, and ground transport helps you identify high-cost areas, plan budgets, and negotiate better deals with suppliers.

3. Review and Negotiate Vendor Deals: As travel volume grows, businesses gain bargaining power. Negotiate preferred rates with hotels, airlines, and car rental providers to reduce overall spend.

4. Move Away From Spreadsheets: Cloud-based T&E systems with mobile capabilities allow employees to upload receipts instantly, automate checks, and give finance teams real-time insights. This improves accuracy and reduces dependency on manual work.

5. Build for Scale, Not Just Today: Choose tools and processes that can support 2x-5x team size growth. Scalable systems ensure that when business expands, T&E operations don’t become a bottleneck.

Turn T&E Challenges into Growth Opportunities

As the organization grows, its travel and expense workflows must grow with it. Challenges like manual tracking, unclear policies, decentralized booking, data silos, and compliance errors are common, but they don’t have to limit efficiency. With automation, unified systems, clear policies, and consistent training, companies can transform T&E from an administrative burden into a strategic advantage. A modern T&E platform gives finance teams complete visibility, employees a smoother experience, and the business more control over costs, laying a strong foundation for sustainable, scalable growth.

Disha Chatterjee

Senior Content MarketerIn this article

1.Challenge 1: Manual Expense Tracking Takes Too Much Time

2.Challenge 2: Lack of Clear Travel Policies

3.Challenge 3: Missing Visibility on Travel Spend

4.Challenge 4: Slow Reimbursements and Employee Frustration

5.Challenge 5: Compliance and Audit Issues

6.Challenge 6: Data Spread Across Different Tools

7.How to Overcome These Challenges

8.Best Practices for Growing Businesses

9.Turn T&E Challenges into Growth Opportunities