Why Finance Teams Are Secretly Losing Money Every Day (And How Expense Management Software Actually Fixes It)

So here's something that's been on our minds a lot lately. Every time we chat with a finance manager at a conference or grab coffee with someone in the industry, the conversation somehow always circles back to the same frustrating reality: they're drowning in manual expense reporting processes.

Take Amy, for example. She's a finance manager at this growing consulting firm, and every Monday morning is basically Groundhog Day for her. She walks into the office and *sighs* – there's 47 expense reports sitting in her inbox from the previous week's client visits. Each one needs to be manually verified, routed through approval workflows, and entered into not one, not two, but three different systems. By Friday, she's still working through Tuesday's submissions, and the sales team is breathing down her neck asking when they'll get their money reimbursed.

This isn't some isolated case either. This is happening everywhere with traditional expense management systems, and honestly, most companies have no clue how much it's actually costing them.

The Real Numbers Behind Manual Expense Management Nobody Talks About

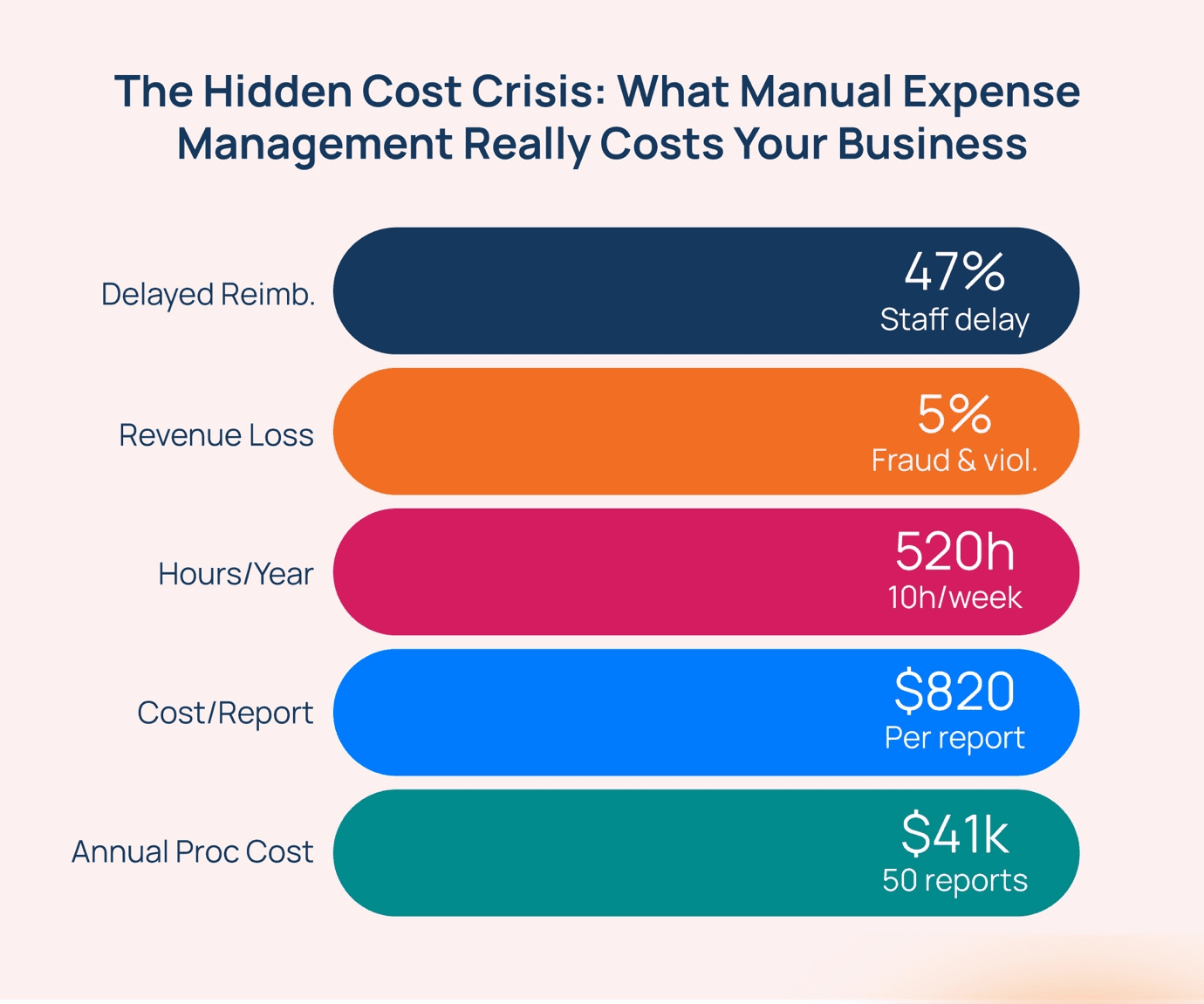

Want to hear something that'll make your CFO's coffee go cold? Companies that process just 50 expense reports monthly are shelling out over $41,000 every year just on processing and fixing these reports. That's not a typo – FORTY ONE THOUSAND DOLLARS. For 50 reports. That's $820 per report when you break it down. (source)

But wait, it gets worse. Finance teams are spending 10 hours each week just processing data and fixing errors. Think about that for a second – that's 520 hours annually. More than three months of full-time work dedicated to what's basically data entry and error correction instead of, you know, actually strategic finance team productivity work. (source)

And here's the kicker: companies lose up to 5% of revenue annually due to expense fraud and policy violations. Five percent! That's not some rounding error – that's serious money walking out the door. (source)

Meanwhile, 47% of employees are getting their reimbursements delayed because of outdated approval processes. So now you've got frustrated employees, overwhelmed finance teams, and money leaking everywhere. It's like trying to fill a bucket with holes in it. (source)

When Manual Corporate Travel Expense Management Falls Apart: Real Stories from the Trenches

Let us paint you a picture of what this actually looks like in the real world of corporate travel expense management.

Read: How Ozonetel Reduces Travel Costs by 11-13% with TripGain’s Automated T&E Solution

There's this mid-sized manufacturing company where they had two people manually processing hundreds of vendor invoices, which requires auditing. Sounds manageable, right? Wrong. The moment one person called in sick, the other was completely swamped, and everything ground to a halt. Imagine being that one person left holding the bag.

Or take this healthcare network we heard about. During an audit, the auditors asked for some historical expense data. Should've been a simple request, right? Nope. The finance team spent 15 days – two and a half weeks! – digging through file cabinets and old email threads trying to piece together documentation that should have been available instantly with proper expense tracking automation.

Also read: Audit Trail

Then there's this SaaS company that was scaling fast. Their finance and accounting team was spending more time chasing missing receipts and fixing GST calculations than they were analyzing burn rates or forecasting growth. The manual GST on business travel work alone was eating up hours every month, and they were constantly finding mistakes that needed to be corrected later.

It's madness, really. But here's what's interesting – every single one of these problems has the same root cause: manual processes that were designed for a different era, before business expense automation became possible.

How TripGain's Expense Management Software Changes the Game: Real Results from Real Companies

Now, we've been working with companies to solve exactly these problems using modern expense management software, and the transformation stories are honestly pretty incredible. These aren't marketing fairy tales – these are real results from real companies using TripGain.

The 2-3 Day Miracle: Automated Expense Reporting at Its Best

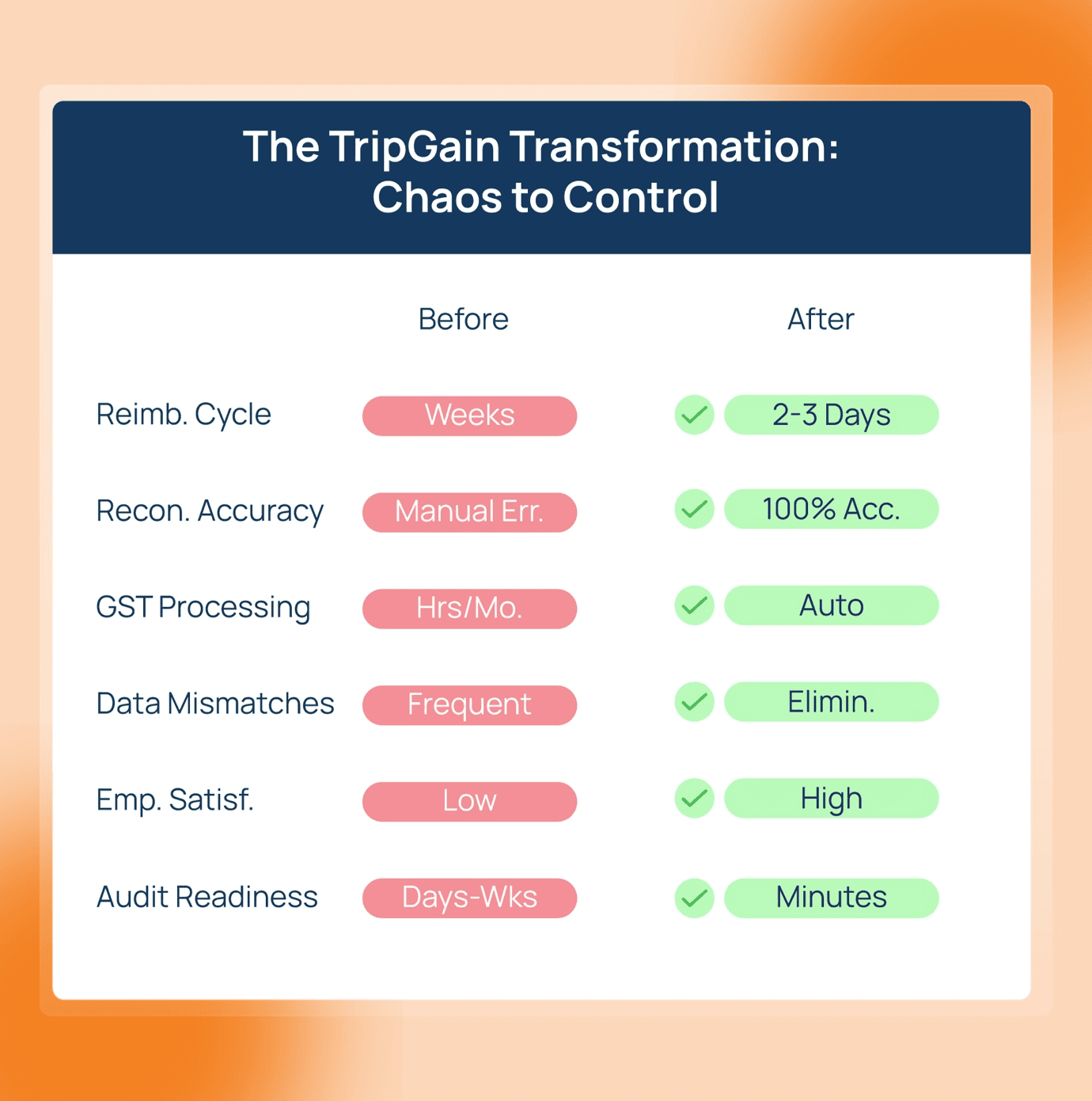

"Our reimbursement cycle reduced from weeks to just 2-3 days" – and this isn't just some one-off success story with our automated expense reporting solution.

Before TripGain, the whole process was this painful dance: employees submit physical receipts via email, wait for manual verification, sit through multiple approval layers, and then watch the finance team manually key everything into their systems. It was like watching paint dry, except more expensive.

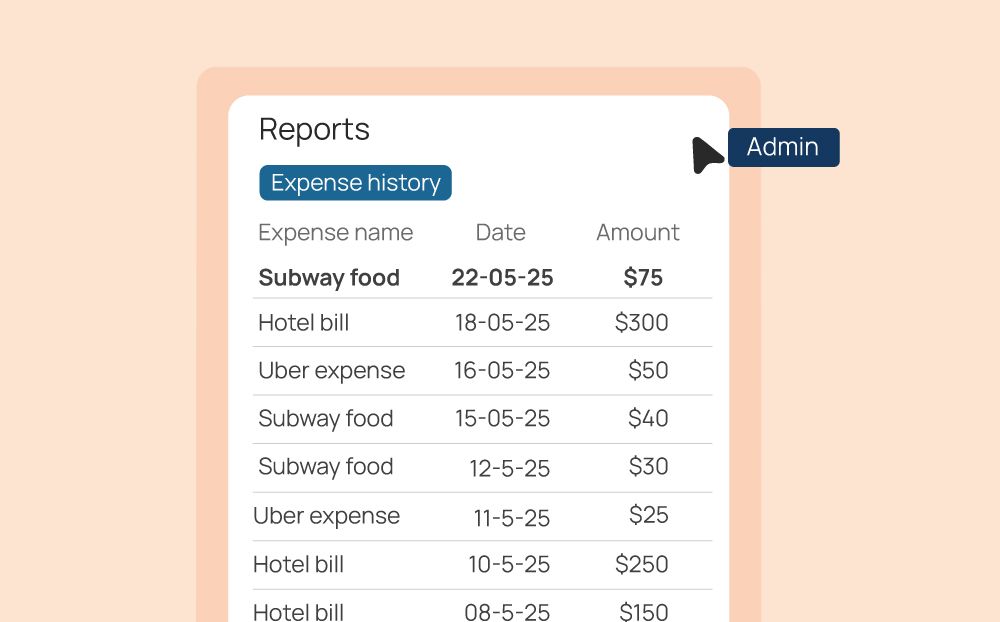

With our automated expense processing platform, everything changes. Expenses get submitted digitally (expense automation) with receipts automatically attached, approvals happen instantly through the system, and the integration with existing finance systems means no more duplicate data entry. The result? Faster employee reimbursements lead to higher satisfaction and reduced complaints.

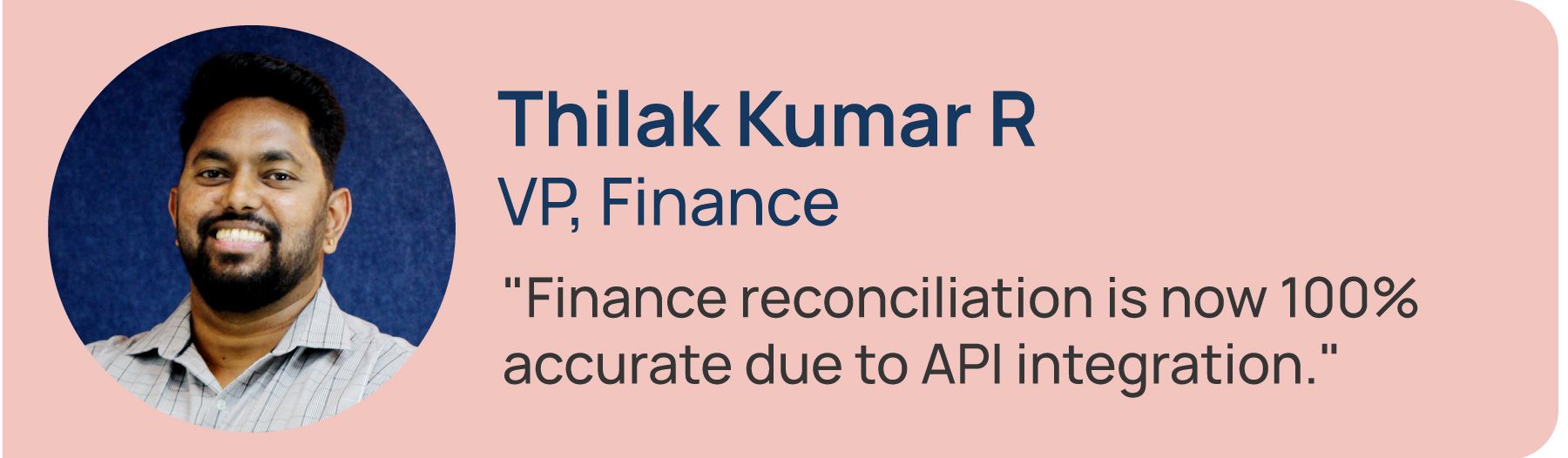

The 100% Accuracy Achievement: Expense Reconciliation Software That Actually Works

"Finance reconciliation is now 100% accurate due to API integration" – and this one's huge because reconciliation errors are basically the bane of every finance person's existence.

Traditional reconciliation means manually matching business travel booking data with expense claims. It's tedious, it's error-prone, and it's exactly the kind of work that makes people question their career choices. Research shows that manual processes can lead to significant delays, with some invoices literally getting stuck on people's desks with no visibility into what's happening. Nobody knows if something was approved, rejected, or just lost.

Our API integration system changes everything through advanced expense reconciliation software. Data syncs in real-time between travel bookings and finance systems, eliminating manual re-entry and human error completely. The result? Zero reconciliation gaps and better compliance during audits.

Also read: Will It Integrate with My Tech Stack?

Goodbye Fraud, Hello Peace of Mind with Integrated Travel Expense Software

"We no longer face mismatched data between travel bookings and expense claims" – and this addresses something that keeps finance leaders up at night.

Whether it's intentional fraud or honest mistakes, mismatched data creates headaches. Our integrated travel and expense solution links bookings and claims in the same system, with expense claims auto-generated from actual bookings. No more scenarios where someone books economy but claims business class expenses, or submits expenses for trips that never happened.

The impact? Eliminates fraud, duplicate claims, and finance team time spent chasing clarifications. No more detective work, no more awkward conversations with employees about suspicious expenses.

One tech services company discovered that 12% of their manual expense submissions had some kind of discrepancy – inflated meal costs, duplicate transportation charges, you name it. Our expense validation system eliminated all of that overnight.

GST Automation Software: From Nightmare to Autopilot

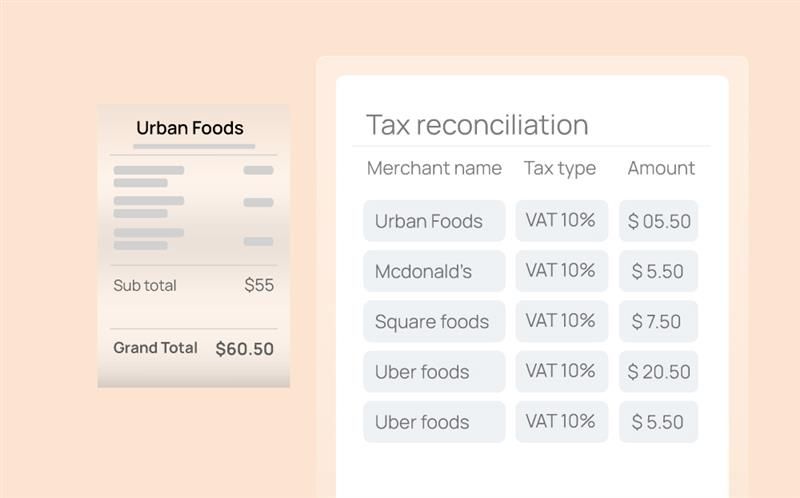

"GST input credit calculation is now automatic, saving hours of manual work every month" – and if you've ever had to calculate GST manually, you know this is basically a gift from the gods.

Manual GST calculation involves checking invoices, validating GST numbers, applying correct percentages – it's repetitive, mind-numbing work that's prone to errors. Our GST automation software calculates GST automatically at booking or expense submission and generates valid GST invoices for future reference. Finance staff hours are saved monthly while ensuring compliance.

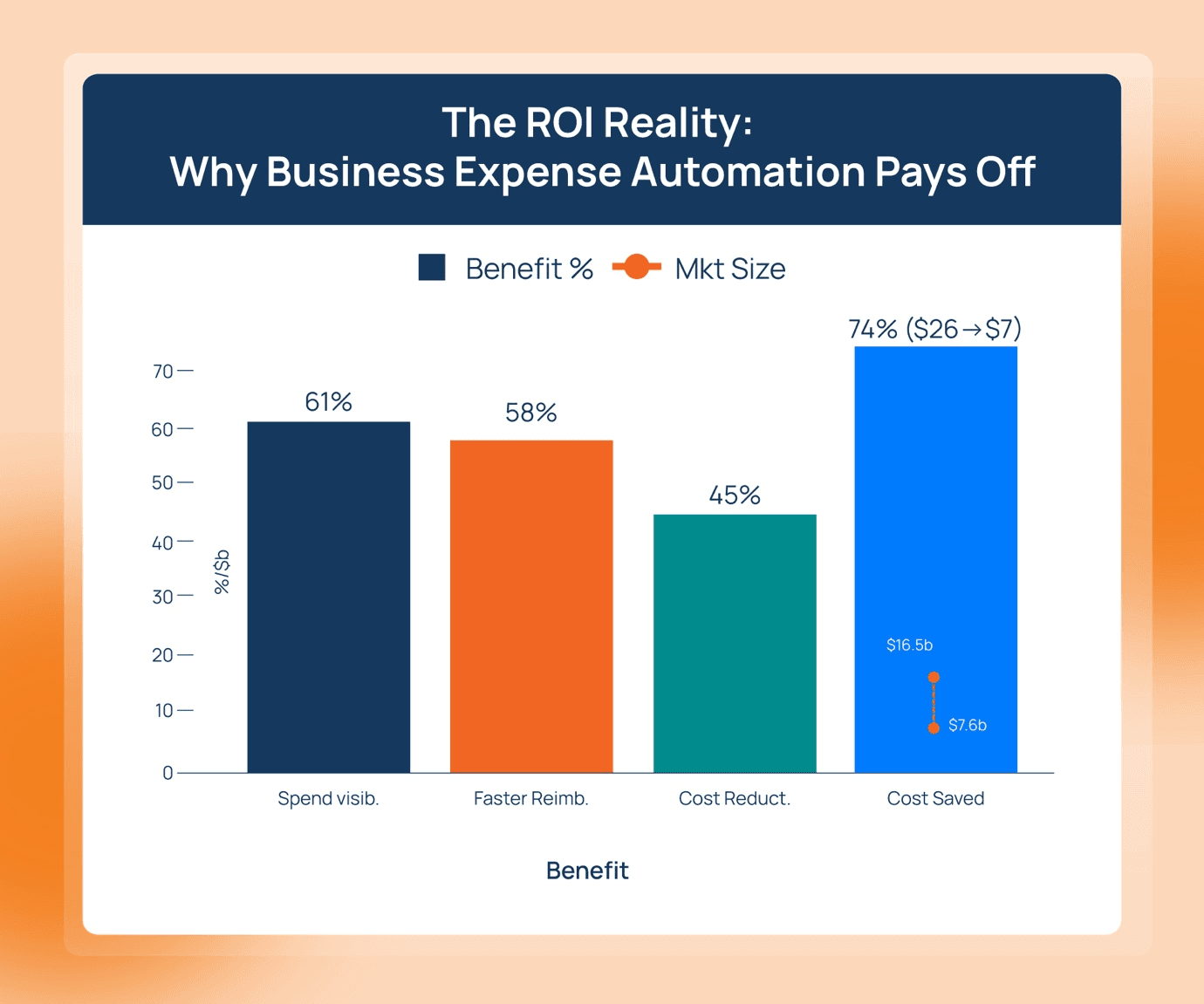

The Numbers Game: Why Business Expense Automation Actually Matters

The expense management software market is exploding – projected to grow from $7.64 billion in 2024 to $16.48 billion by 2032 – and it's not because of some tech fad. It's because the ROI of business expense automation is undeniable. (source)

Companies implementing expense automation are seeing:

- 61% improved visibility over spend

- 58% quicker employee reimbursements

- 45% reduction in processing costs overall

- 74% savings on processing costs when moving from manual ($26.63) to automated ($6.85) processes

Industry research shows that businesses are achieving 40+ hour weekly savings, 90% automation rates, and significant reductions in processing time after implementing modern expense management systems. This isn't theoretical – these are real measurable results.

What Has TripGain Done Beyond Traditional Expense Management

- Real-Time Cash Flow Visibility with Advanced Expense Tracking Automation

- Audit Confidence with Complete Expense Management System Integration

- Vendor Relationships Enhanced Through Automated Expense Reporting

Expert Insights: How TripGain Transforms Travel & Expense Management

We asked our VP of Finance, Thilak Kumar R, to share his first-hand perspective on TripGain’s impact on corporate travel and expense management. Here’s how he thinks TripGain is transforming expense management for modern businesses.

Q: How does TripGain speed up the reimbursement cycle?

A: Employees submit expenses digitally with receipts attached, approvals are instant, and data flows directly into the finance system. This reduces the cycle from weeks to just 2-3 days, leading to faster reimbursements and fewer employee complaints.

Q: Reconciliation has always been a headache for finance teams. How is this solved?

A: With API integration, travel bookings sync directly with the finance system in real time. That means no duplicate entry, no mismatches, and 100% accurate reconciliation - giving us complete confidence during audits.

Q: Expense fraud is a real concern. How does TripGain address it?

A: Because bookings and claims are linked in the same system, expense claims are auto-generated from actual bookings. This prevents duplicate submissions, inflated costs, or claims for trips that never happened.

Q: What about GST compliance - often one of the most time-consuming tasks?

A: GST calculation is now fully automated. The system validates GST numbers, applies correct rates, and generates compliant invoices. This saves hours every month and ensures we never miss eligible credits.

Q: How does automation help during audits?

A: Every record - bookings, approvals, receipts - is stored digitally with timestamps. Instead of days of manual retrieval, auditors can get what they need in minutes. That builds real compliance confidence.

Q: Vendor management is another bottleneck. What’s changed with TripGain?

A: Vendor invoices now link directly to bookings and are auto-matched to POs. Due dates are tracked, and alerts prevent delays. This avoids late penalties and strengthens vendor relationships.

Q: How has expense automation impacted cash flow planning?

A: With real-time syncing, expenses are visible the moment bookings are made - not weeks later. That gives us accurate cash flow forecasting, better fund allocation, and stronger liquidity management.

Ready to Stop the Money Leak with Modern Expense Management Software?

Here's the thing: manual expense management is a luxury modern businesses simply can't afford anymore. With industry leaders achieving 40+ hour weekly savings through expense tracking automation, 90% automation rates with automated expense reporting, and 100% reconciliation accuracy using expense reconciliation software, the question isn't whether to automate – it's how quickly you can get started.

Finance teams deserve better than drowning in spreadsheets and chasing receipts. Organizations deserve the strategic insights that come from having finance focused on driving business growth instead of just keeping up with data entry through modern expense management systems.

Well, TripGain is Here to Solve That…

We've helped dozens of companies make this transformation using our corporate travel expense management platform, and the results speak for themselves. The only real question is when your transformation begins.

Want to see what TripGain's expense management software could actually do for your specific situation? Let's have a conversation about your real numbers, actual pain points, and solutions tailored to what your organization actually needs. Because honestly, the cost of not implementing business expense automation might be higher than you think.

Schedule a personalized demo and let's talk about turning your expense management from a cost center into a competitive advantage with our travel expense software.

Godi Yeshaswi

Senior Product MarketerIn this article

1.The Real Numbers Behind Manual Expense Management Nobody Talks About

2.When Manual Corporate Travel Expense Management Falls Apart: Real Stories from the Trenches

3.How TripGain's Expense Management Software Changes the Game: Real Results from Real Companies

4.The Numbers Game: Why Business Expense Automation Actually Matters

5.What Has TripGain Done Beyond Traditional Expense Management

6.Ready to Stop the Money Leak with Modern Expense Management Software?

7.Well, TripGain is Here to Solve That…