The Finance Blueprint for Smarter Corporate Travel Management

Corporate travel has entered a new growth phase: global business travel spending has reached US $1.57 trillion in 2025, according to the Global Business Travel Association.

For most organizations, travel & expense (T&E) now ranks among the top three controllable expense categories after salaries and technology investments. With rising prices, increased international movement, and heightened board-level scrutiny of return on investment, finance teams can no longer rely on legacy manual or reactive methods.

Today’s finance function must deliver real-time visibility, enforce policy consistently, identify leakage proactively, and ensure every trip aligns with measurable business outcomes. This means shifting from simple cost tracking to data-driven travel spend optimization, supported by automation and intelligent analytics.

The Hidden Costs That Undermine Travel Budgets

Even when large ticket items like flights and hotels are tracked, the real erosion of budget often comes from unseen areas - expenses that bypass control, arrive late, or go entirely unrecorded. According to the Deloitte ‘Forecast in Flux: 2025 Corporate Travel Study’, 54% of travel managers say rising costs are among the top constraints limiting business travel this year.

Primary areas of unmanaged spend include:

- Bookings made outside the approved system (no preferred rates, no compliance check)

- Missing, duplicate, or incorrect expense receipts

- Last-minute changes or upgrades (higher cost, low visibility)

- Foreign exchange mark-ups, premium transaction fees

- Multiple unconnected systems that prevent consolidated spend analysis

When travel and expense data sit in silos, bookings in one system, expenses in another, accounting in spreadsheets - finance sees the cost only after the fact. That delay means limited ability to influence decisions or stop overspend before it happens.

The Strategic Finance Approach to Travel & Expense Control

Finance teams today move beyond post-trip reconciliation to actively shaping travel decisions. This evolution is evident in the practices of forward-thinking finance leaders:

- Budget ahead of the spend: They forecast travel demand by business unit, destination or travel type (client meetings, field work, events) and assign budgets accordingly.

- Analyze patterns: They review spend by department, supplier, route, and trip type to identify high-cost areas.

- Collaborate with stakeholders: They partner with HR, operations and business units to embed travel decisions into corporate strategy.

- Negotiate with data: They use actual spend and booking behaviour to drive better rates with airlines, hotels and ground transport.

Deloitte’s 2025 study found that 74% of travel managers expect budgets to expand this year, yet at the same time, cost concerns are rising and 10% of companies anticipate budget cuts, especially among larger companies.

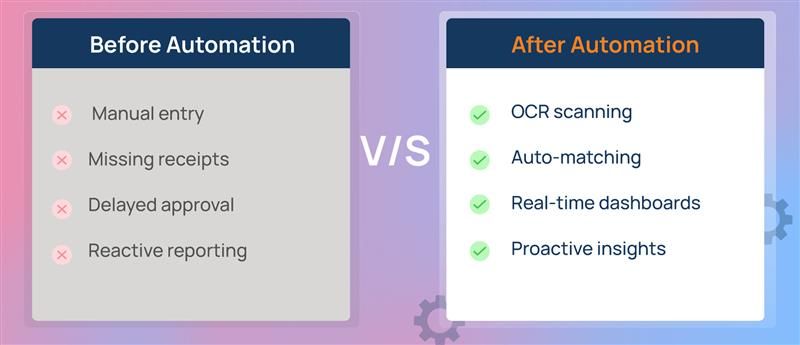

Automation & Data - The Real Power Engine Behind Expense Control

Technology is no longer optional in travel spend management, it’s essential. The trend is clear, organizations are moving rapidly from manual workflows to integrated, intelligent systems.

Here are key capabilities of modern systems:

- OCR & AI receipt capture: Travel receipts are snapped, data extracted automatically, reducing manual entry and lost claims.

- Policy violation detection in real time: Systems flag bookings or expenses outside policy - for example, a premium seat, non-preferred hotel or last-minute booking.

- End-to-end integration: Booking systems, expense tools and accounting/ERP systems are linked, so finance sees the full lifecycle.

- Analytics & dashboards: Real-time visibility into cost per trip, compliance rates, high-risk spend areas, enabling early intervention.

With the right automation and data architecture, finance teams shift from manual processing to insight generation, driving travel spend optimization, not just cost containment.

Traveler Behavior & Policy Design

Technology and data are powerful, but real change hinges on understanding human behavior. Tools alone don’t fix spend issues; policy design and traveler experience do.

Key elements of effective travel policy design:

- Clarity: Policies must use plain language, not legalistic jargon, so travelers understand expectations.

- Embedded guidance at booking stage: Presenting cost variance at the point of booking - for instance, revealing that selecting a non-preferred hotel increases spending by 17%, significantly increases on-policy behaviour.

- Mobile-friendly self-service: Travel apps and expense apps must be intuitive for users on the move.

- Feedback & incentives: Reward on-policy choices, provide traveler visibility into how their choices impact budgets and outcomes.

- Culture alignment: HR and finance should partner to create a travel culture of accountability, not policing, so that compliance is part of workflow, not resistance.

When travelers feel supported (vs constrained), compliance rises, satisfaction improves and controlled spending becomes embedded in behavior rather than enforced through paperwork.

Using Expense Insights to Get Ahead

Beyond compliance and capturing spend, the most progressive finance teams turn expense data into a strategic advantage, using analytics to direct future travel decisions.

Insight-powered decision-making helps companies:

- Vendor negotiation leverage: Travel data enables you to show booking patterns, volume and supplier usage, giving you stronger footing in supplier contracts.

- Forecasting & benchmarking: Historical data on trips, destinations, cost per traveler and team performance lets you predict future budgets and control deviations.

- Behavioral segmentation: Identify which teams or travelers consistently go off-policy or incur higher cost and tailor training, policy tweaks or system prompts accordingly.

- ROI analysis of travel: Link travel spend to business outcomes - client wins, revenue, and retention to ensure travel is aligned with strategic objectives.

In effect, travel expense data becomes part of the corporate intelligence toolkit, not just an accounting record.

Common Mistakes and How to Avoid Them

Even mature finance functions encounter challenges in achieving complete T&E efficiency. Here are frequent pitfalls and how to counter them:

- Fragmented systems: When travel booking systems, expense tools, and accounting/ERP platforms operate in silos, it creates data blind spots that limit visibility and control. The solution is to adopt an integrated T&E platform or ensure strong, seamless interoperability between systems.

- Complex / outdated policies: When policies are complex or outdated, travelers often misunderstand requirements or bypass compliance. The remedy is to refresh policies annually, simplify the language, and embed guidance directly at the point of booking.

- Reactive processes: When expenses are reviewed only after reimbursement, finance loses the ability to influence spend or prevent non-compliant costs. Implementing real-time dashboards, automated alerts, and pre-trip approval workflows strengthens control before costs are incurred.

- Treating travel as cost centre only: Travel expenses are not being evaluated for their impact on business performance. To address this, create performance metrics that directly correlate travel investments with revenue, client outcomes, growth efficiency, and sustainability progress.

- Lack of traveler experience focus: When tools or policies make the process difficult, employees naturally bypass them, leading to non-compliance. To fix this, prioritize user-friendly design, mobile-first workflows, and clear communication supported by continuous training.

Addressing these ensures the T&E process isn’t just controlled, it’s efficient and aligned.

Best Practices for High-Performing T&E Management

Here are practical steps every finance team should take:

- Conduct quarterly reviews of travel and expense data, by destination, team, trip type, cost per traveler

- Deploy automation for receipt capture, expense matching, policy violation detection and approval workflows

- Ensure system integration between your booking, expense and accounting/ERP platforms

- Refresh your travel policy every 6-12 months to reflect changing markets, traveler behavior and cost inflation

- Build dashboards and analytics to track key metrics like cost per trip, of out-of-policy booking percentage, high-cost routes, supplier performance

- Empower travelers with mobile tools and nudges, so compliant choice is easier than out-of-policy choice

- Align the travel programme with strategic business outcomes - revenue, client engagement, sustainability goals

When implemented, these practices shift travel from a cost burden to a controlled, predictable, strategic investment.

Final Thoughts

In 2025 and moving into 2026, finance teams can no longer treat business travel & expense management as a back-office function. With global travel spend hitting US $1.57 trillion and rising scrutiny from leadership, business travel expense management has become a strategic discipline.

Finance teams that eliminate leakage, deploy automation, shape traveler behavior and transform expense data into actionable insight will gain real advantage. Travel decisions are business decisions, and the finances need to lead them.

Begin by asking, ‘Where are we losing visibility? What data are we not leveraging? What automation would unlock for us? And that will help you shift from simply controlling cost to driving value.

FAQ

What are the hidden costs of business travel?

Costs such as out-of-policy bookings, FX or payment fees, missed receipts, upgrades, premium seats and unmanaged ancillary spend all erode budgets.

How can finance teams stop unmanaged spend?

By centralizing booking channels, embedding policy checks at the point of decision, linking booking, expense, and finance systems, and using alerts for out-of-policy spend.

What tools help manage travel and expense better?

Modern T&E platforms that support automation (OCR, AI), integrate booking, expense, and accounting workflows, provide dashboards and enforce policy.

How can small behavior changes boost compliance?

Clear policy language, mobile experience, real-time nudges, traveler visibility into cost impact and incentives for good behavior promote compliance more effectively than heavy enforcement.

How can travel data help companies make smarter budget plans?

By analyzing trends in spend, trip frequency, destination cost, team behavior and supplier usage, companies can forecast more accurately, negotiate better terms and align travel with business strategy.

Disha Chatterjee

Senior Content MarketerIn this article

1.The Hidden Costs That Undermine Travel Budgets

2.The Strategic Finance Approach to Travel & Expense Control

3.Automation & Data - The Real Power Engine Behind Expense Control

4.Traveler Behavior & Policy Design

5.Using Expense Insights to Get Ahead

6.Common Mistakes and How to Avoid Them

7.Best Practices for High-Performing T&E Management

8.Final Thoughts

9.FAQ