Managing Multi-Entity, Multi-Country Corporate Travel Spend - A Finance Leader’s 2026 Strategy

For organizations operating in two or more legal entities across multiple countries, business travel is no longer just an operational cost. It intersects with tax compliance, audit readiness, financial reporting, and global governance. As companies expand, travel spend becomes not only a financial metric to manage, but a strategic risk vector to govern.

According to GBTA, global business travel spending reached approximately US$1.57 trillion in 2025, marking one of the highest levels ever recorded for the sector, despite economic and geopolitical uncertainty. This trajectory underscores the growing scale and complexity of corporate travel for large and expanding enterprises.

Against this backdrop, finance leaders must ask critical questions - When and how does travel create indirect tax exposure? Are cross-border travel patterns creating permanent establishment risks? Is each legal entity capturing its share of input tax credits, and are expenses reconciled correctly for audit purposes? Addressing these questions requires a governance-first approach to travel spend, one that integrates financial controls with tax and compliance frameworks.

The Global Travel Spend Landscape - What CFOs Need to Know

Current Business Wire data shows that business travel spending is forecast to grow about 6.6% in 2025, even amid trade policy uncertainty and inflationary pressures, with an eventual rebound expected in 2026.

This data carries two important implications for multi-entity organizations:

- Business travel continues to be strategic: CEOs and CFOs often view it as essential to client relationships, cross-border engagements, and global business operations. Survey data also reveals that around 86% of business travelers believe their trips are worthwhile for achieving business objectives, and average trip spending per traveler is rising.

- The spend is uneven across regions and entities: Markets such as India, South Korea, and Turkey are among the fastest-growing business travel markets, indicating that companies’ cost and tax exposures may vary substantially by geography.

These dynamics mean that strategic leaders cannot treat travel as a line-item in the finance ledger alone, it must be governed as a cross-functional priority that intersects finance, tax, legal, and operations.

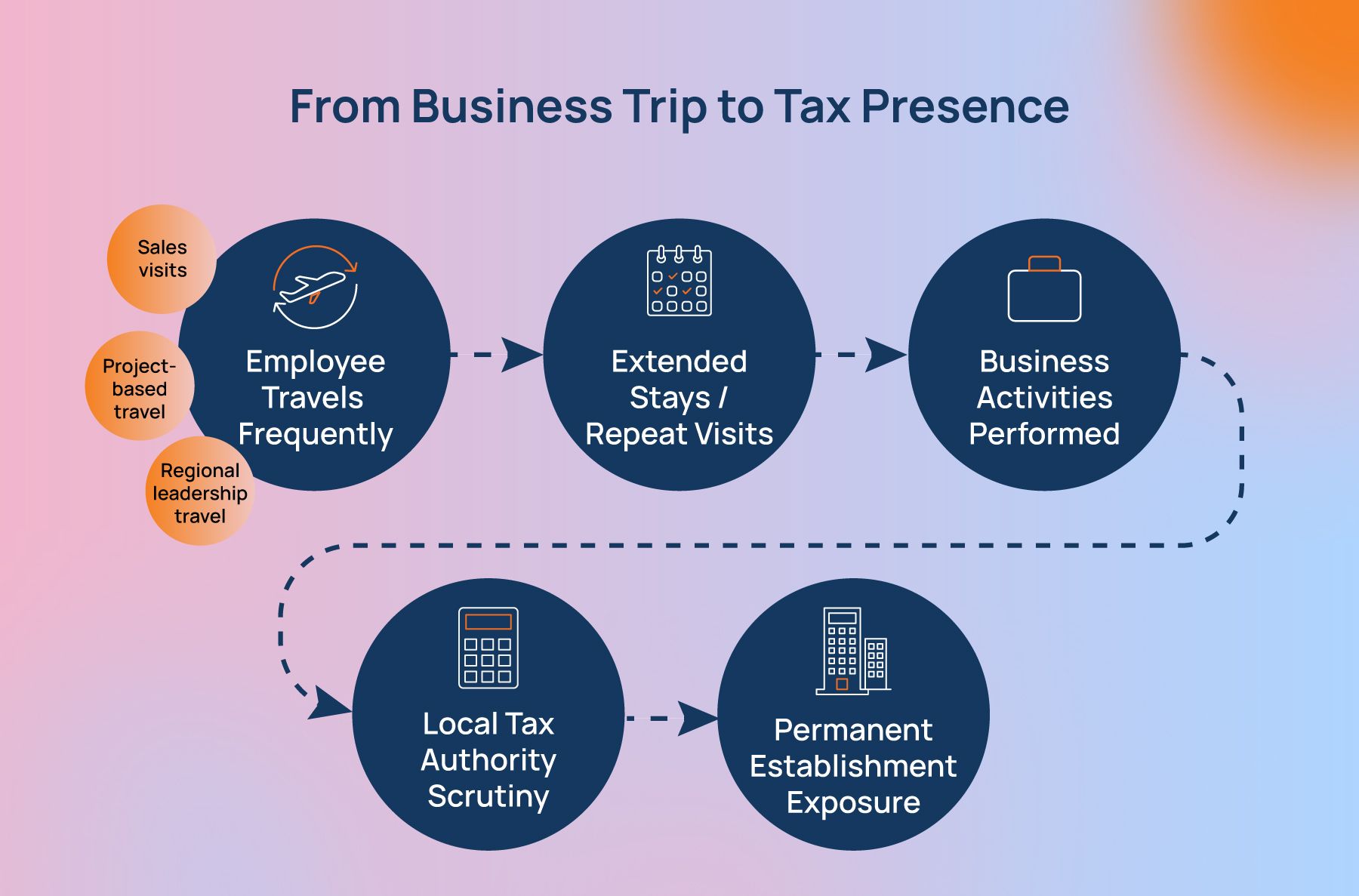

Compliance & Tax Exposure: Why Travel Can Trigger Risk

When employees travel frequently or stay extended periods in foreign jurisdictions, local tax regimes can interpret this as the organization having a permanent establishment, leading to corporate income tax obligations in those jurisdictions. In markets with strict nexus rules, such as in many Organization for Economic Co-operation and Development (OECD) jurisdictions, the threshold for creating a taxable presence can be surprisingly low.

For finance leaders, this means that travel patterns become a compliance signal, not just a cost driver. Organizations that fail to track where employees are spending time and how long, risk unanticipated tax liabilities and regulatory scrutiny.

Indirect Tax Treatment Across Jurisdictions

Indirect taxes such as VAT and GST have a direct impact on how multi-country travel spend is managed and reported. In global organizations, travel expenses are taxable transactions, and their treatment depends on where services are consumed, how they are invoiced, and which legal entity ultimately bears the cost.

Globally, VAT and GST operate as destination-based consumption taxes, with recovery of input tax permitted only when documentation, registration, and transaction classification requirements are met, as outlined in the OECD International VAT/GST Guidelines.

Business travel introduces complexity because services are often consumed by employees but paid for by a corporate entity in another jurisdiction. Without clear visibility into who the taxable customer is and how the expense is attributed, finance teams may struggle to determine whether indirect tax has been applied correctly or can be reclaimed.

The financial impact is significant. Global tax studies indicate that a large share of VAT embedded in business travel expenses is never recovered, not due to ineligibility but because of incomplete invoices, inconsistent documentation, or incorrect entity attribution. Over time, this creates meaningful cost leakage for multi-entity organizations.

For finance leaders, this makes indirect tax treatment a governance issue rather than a back-office exercise. Embedding tax logic, documentation standards, and entity-level controls into travel and expense processes is essential to protect margins, reduce audit risk, and support compliant international growth.

For each jurisdiction, proper invoicing, registration, and recording are essential. Without audit-ready documentation, businesses may be unable to claim input tax credits or worse, face penalties during tax authority reviews. Finance operations must therefore include indirect tax governance as part of expense reconciliation, rather than treating it as a back-end accounting task.

Entity Attribution & Financial Reporting Challenges

Multi-entity organizations often face mismatches between who books travel and who benefits from it. For example, a regional headquarters may pay for travel that benefits multiple legal entities. But without a clear attribution framework, finance teams struggle with intercompany cost allocation, transfer pricing documentation, and statutory reporting, weakening financial transparency.

To address this, organizations must establish entity-aware policies and systems that tie each travel transaction to the appropriate legal entity and business purpose, ensuring that spend is reflected correctly in subsidiary financials and consolidated reporting.

What Metrics Finance Leaders Should Track

For a governance-centric approach, finance teams should measure beyond raw spend totals. Key metrics that indicate maturity in global travel spend governance include:

- Entity Attribution Accuracy: Measures how consistently travel expenses are recorded against the correct legal entity. High accuracy signals that finance systems are aligned with the organization's legal structure, reducing misallocation risks and exposure during audits.

- Indirect Tax Capture Rates: Track the proportion of cross-border travel expenses supported by valid VAT or GST documentation. This metric reflects how effectively the organization preserves tax recovery opportunities and avoids permanent value leakage.

- Audit-ready Documentation Rates: Indicate the availability and completeness of supporting records for travel expenses. Strong performance here reduces audit preparation time, limits compliance risk, and improves confidence during regulatory reviews.

- Travel Duration and Frequency by Location: This analysis helps identify early indicators of tax nexus or permanent establishment risk. Monitoring these patterns allows organizations to address potential liabilities before regulatory thresholds are breached.

- Policy Compliance Consistency Across Subsidiaries: This highlights governance gaps in multinational environments. Variations in compliance often point to the need for jurisdiction-specific policy refinements rather than one-size-fits-all controls.

Frameworks for Governance & Sustainable Growth

In today’s environment, modern travel and expense platforms are more than cost trackers. They are compliance engines that embed tax logic, entity rules, and jurisdiction-specific governance within booking and expense workflows. This helps finance leaders not only control spend but also enforce policy consistently, capture indirect tax credits, and prepare for audit with confidence.

Final Thoughts

For organizations with multinational footprints and complex entity structures, managing travel spend requires a compliance-first mindset. Corporate travel now intersects with tax exposure, cross-entity accounting, indirect tax governance, and audit readiness. Finance leaders who embed governance into travel spend strategies will find themselves better prepared to support global growth, manage risk, and improve financial transparency, all while capturing hard savings through indirect tax recovery and more accurate reporting.

FAQ

1) Why is multi-entity travel spend a financial risk, not just an operational cost?

Because travel creates tax exposure, audit risk, and entity-level misreporting when costs, benefits, and compliance obligations span multiple jurisdictions.

2) How can business travel trigger permanent establishment risk?

Frequent or extended employee presence performing business activities in another country can create a taxable nexus under local and OECD rules.

3) Why do companies lose VAT/GST on international travel expenses?

Most losses occur due to incorrect entity attribution, non-compliant invoices, or missing documentation, rather than ineligibility.

4) What is entity attribution in corporate travel spend?

It is the process of assigning travel costs to the correct legal entity that benefited from the trip, not just the entity that paid.

5) What should finance leaders track beyond total travel spend?

Key metrics include entity attribution accuracy, indirect tax capture rates, audit-ready documentation, travel duration by location, and policy compliance consistency.

Disha Chatterjee

Senior Content MarketerIn this article

1.The Global Travel Spend Landscape - What CFOs Need to Know

2.Compliance & Tax Exposure: Why Travel Can Trigger Risk

3.Indirect Tax Treatment Across Jurisdictions

4.Entity Attribution & Financial Reporting Challenges

5.What Metrics Finance Leaders Should Track

6.Frameworks for Governance & Sustainable Growth

7.Final Thoughts

8.FAQ