SME Travel & Expense Guide: From Cost Control to Growth Strategy

Business travel is not only a cost center for small and mid-size businesses (SMEs), it's a driver of growth. Whether meeting customers, forming partnerships, or venturing into emerging markets, business travel is essential to taking operations to the next level. Thus, unmanaged travel and expense (T&E) processes can quietly erode margins, lower productivity, and even put SMEs at risk of compliance issues. (source)

(source)

This handbook is meant to empower SME leaders, finance professionals, and operations staff in managing travel and expenses. You will discover:

- Budgeting models that harmonize travel expenditure with business objectives

- How to save costs without sacrificing employee comfort or productivity

- Utilitarian tools such as travel policy templates and expense report tracking

- GST and compliance solutions to maximize Input Tax Credit (ITC) and steer clear of red flags

- Scalable methods to contain travel as your company expands

By the end of this guide, you will be equipped with the insights, templates, and industry best practices to transform your business T&E into a strategic advantage, not just another operational headache.

Why Business Travel Matters for Growing SMEs

For many SMEs, the first sales pitch, client handshake, or cross-city deal closure happens face-to-face. Business travel remains one of the most effective ways to:

- Build lasting client relationships

- Opening new markets and collaborations

- Enhance team culture and collaboration

For SMEs, travel is not merely an operational process, it's an enabler of revenue. Getting it right can influence sales growth, client retention, and profitability directly.

T&E Spend within the SME Context

For SMEs, travel and expense spend generally encompasses:

- Flights & Trains

- Hotels & Accommodation

- Meals & Entertainment

- Ground Transport (cabs, rentals)

Small businesses tend to spend more on travel than large companies, because they don't have negotiated rates. Though each of these items might seem insignificant on its own, collectively they can eat up a large percentage of SME operating expenses.

Knowing your T&E spend is the key to being able to control it - SMEs that track and audit travel expense early are in a better position to scale successfully.

How to Create a Working Travel Budget

For SMEs, travel expense can be unpredictable. An effective budget turns it from a cost factor into a strategic tool.

Essential Steps to Create a Travel Budget:

- Set annual & quarterly targets: Tie travel expense to revenue targets

- Forecast travel needs: Include events, client visits, and launches

- Allocate by category: Flights, hotels, meals, ground transport, misc

Goal-linked business budget guarantees that each rupee spent on travel generates a quantifiable return.

Per Diem vs Actuals: What's Right for You?

Most SMEs start with per diem, but as compliance becomes greater (such as GST ITC claims), actuals are preferred (source).

Per Diem (Daily Allowance)

- Advantages: Easy, foreseeable, reduced paperwork.

- Disadvantages: Potentially overpays in low-value destinations.

Actuals (Reimbursement of Receipts)

- Advantages: Precise expense tracking, simplified GST compliance.

- Disadvantages: Increased admin workload if done manually.

How to Reduce Travel Expenses Without Compromising Quality

Savings does not equal penny-pinching. SMEs can save a great deal on travel by adopting smart moves:

Smart Booking Tactics

Advance Booking: Booking a flight at least three weeks before departure and up to about 2.5 months prior falls within the Prime Booking Window and often offers the lowest fares. Waiting until less than a week before the trip can mean paying 59% more (source).

AI-Powered Recommendations: Platforms such as TripGain assist in synchronizing bookings with budget. By analyzing historical travel data, policy rules, and live inventory, AI ensures employees always see the most cost-effective, policy-compliant options first. This not only reduces leakage but also helps SMEs save up to 20-30% on overall travel spend.

Policy-Driven Savings

Cancellation Fee Agreements: SMEs can negotiate flat or reduced cancellation fees with airlines, hotels, and travel partners. This prevents budget overruns when plans change last minute.

Internal Use of Virtual Meetings: A smart travel policy balances essential in-person trips with virtual alternatives. Routine check-ins or internal discussions can be shifted to platforms like Teams or Zoom, ensuring that travel budgets are reserved for client meetings, sales, and business-critical engagements.

Compliance with GST: Travel policies should require employees to collect GST-compliant invoices for hotels, flights, and ground transport. This enables businesses to claim Input Tax Credit (ITC) on eligible expenses and avoid missed opportunities for savings. Missed ITC claims can reduce businesses' annual profits by as much as 7-8% states ETCFO.

Cost management is about wiser, policy-supported, and technology-assisted travel choices, not reduced trips.

Creating a Travel Policy for Your SME

For most SMEs, business travel used to be ad-hoc, with staff booking on consumer apps and incurring separately later. It suffices as a small team, but as business travel increases, so does its complexity: unmanaged bookings, disparate expense reports, and lost tax savings.

A well-designed travel policy is not red tape, it's a facilitator of cost savings, compliance, and employee experience.

BTN's 2025 Small & Midsize Enterprise Business Travel Durability Report indicates a marked shift - SMEs are increasingly transitioning from unstructured, ad-hoc booking systems to formalized, technology-supported travel programs. Organizations that implement formalized travel policies with specified booking channels, standardized approval processes, and digital documentation, have improved control over expenditure, accelerated reimbursements, and quantifiable cost savings.

Major pillars of an SME travel policy:

Booking Clarity: Specify the allowed booking channels - centralizing bookings through one partner or system avoids fragmentation and enhances negotiating leverage with suppliers

Expense Guardrails: Rather than micromanaging, impose general but clear limits to empower staff and prevent budgets going off track

Approval Flows: Make them lean - for most SMEs, a manager and a finance approval is sufficient. Adding layers hinders decision speed and raises costs

Flexibility Clause: SMEs expand rapidly. Your policy must provide exceptions for high-value opportunities such as emergency client meetings or partnership discussions

Compliance: Mandate GST-compliant invoices and electronic receipts. This easy step can be the difference between realizing input tax credits or leaving money on the table.

Expense Management for SMEs: Manual vs Automated

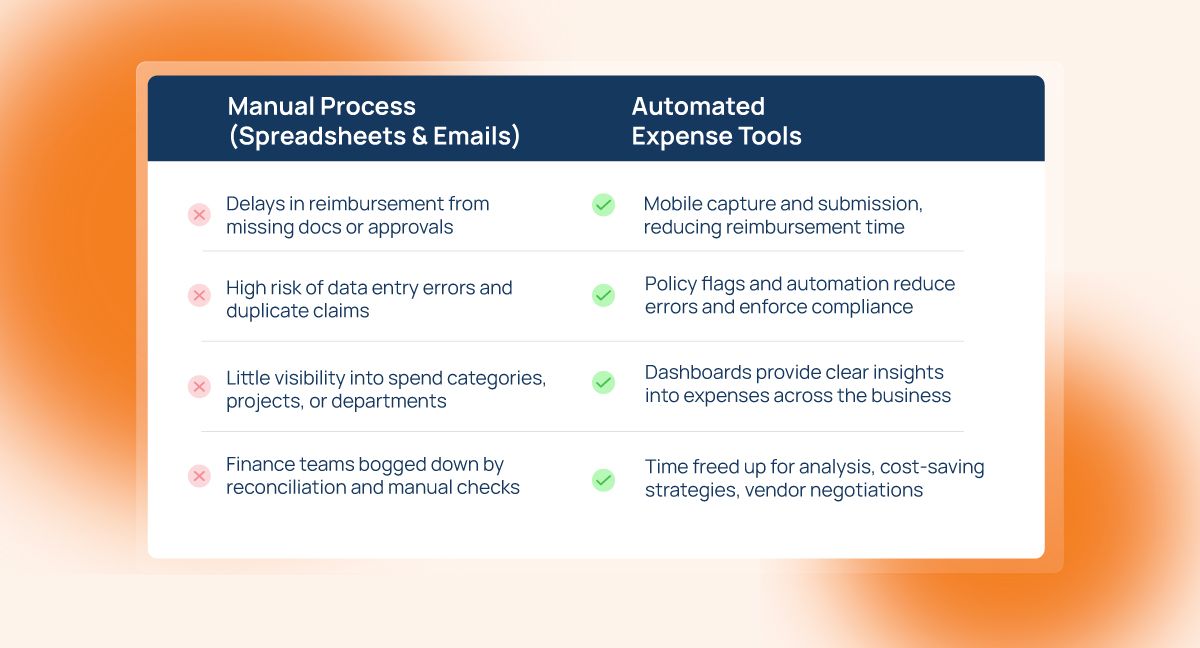

NetSuite's 2025 industry trends report states that automated expense management systems are redefining how SMEs manage costs and gain compliance. Powered by AI, predictive analytics, and mobility, these platforms automate mundane tasks such as receipt capture and expense tagging, alert possible policy infractions prior to submission, and accelerate approval and reimbursement processes. This modernization not only eliminates errors and missing receipts by hand but offers real-time visibility for leaders, enabling wiser spending, quicker cash flow, and better compliance even as businesses grow and work patterns become hybrid and distributed. Most SMEs continue to use spreadsheets and email to manage expenses, but this causes lost receipts, late reimbursements, duplicate claims, and poor visibility into where money is going. Finance staff spend hours in reconciliation, and leadership has no visibility at the client or project level of spend.

Compare this to automated digital technology - workers snap a receipt for immediate capture, policy guardrails ensure out-of-policy claims are blocked, and expenses flow easily to approvers for quicker reimbursement. With GST-ready classification and real-time dashboards, owners and CFOs have full visibility and control, making expense management no longer a manual chore, but a strategic asset.

Automation is not a luxury for SMEs, it's a cash flow discipline and regulatory compliance lever.

Best Practices for Approvals, Reimbursements, & Visibility

Organizations that utilize automated approval systems have a 26% decrease in non-compliant expenses and a maximum of 5% decrease in yearly revenue lost to policy abuse and expense fraud (source).

Best practices to lean down approvals:

- One-step or two-step approvals at most

- Utilize electronic workflows so approvers can respond from email or mobile

- Invite managers to pre-approve anticipated trips

Best practices for prompt reimbursements:

- Set a hard SLA

- Have monthly cycles for predictability

- Speedier repayments enhance employee confidence and morale

Best practices to prevent fraud & errors:

- Employ duplicate detection automated

- Make digital receipts mandatory

- Perform regular audits - not to punish, but to educate employees on compliance

Best practices to ensure central visibility:

- Construct one consolidated dashboard of all T&E spend

- Report by project, department, or client

- Leverage visibility to negotiate improved rates with hotels, airlines, and agencies

GST for Business Travel: SMEs Must Know

For SMEs, business travel is not just a logistical exercise, it is a substantial cost center where latent efficiencies can be tapped. The least used lever among them is Input Tax Credit (ITC) under GST. While most small businesses perceive GST compliance as a statutory mandate, visionary leaders who go at it strategically recognize it as a cash flow benefit that directly contributes to margins.

Unleashing ITC on Travel Spend

Company-sponsored travel expenses like domestic airfare, hotel stays, taxi services, conferences, and even meals charged with GST can all qualify for ITC, as long as they are in strict business use and accompanied by compliant invoices. SMEs forego these claims far too frequently due to employees providing incomplete paperwork, or because the finance departments use GST as a ‘pass-through’ and not as a recoverable asset.

The Compliance Framework that Matters

The provisions, in Section 16 of the CGST Act, are simple on paper but operatively challenging in real life:

- A proper tax invoice or debit note must be present, with the supplier's GSTIN, HSN/SAC code, and place of supply

- The service must be received, and payment made within 180 days

- Most importantly, the supplier should have submitted the invoice in GSTR-1, and it needs to auto-populate in the company's GSTR-2B

In the absence of this electronic reconciliation, ITC cannot be claimed, pay GST or not. But claims need to be submitted by 30th November of the next financial year or prior to the company submitting its annual GST return (GSTR-9), whichever is earlier (source).

Common Pitfalls SMEs Face

Non-GST compliant invoices: Cab aggregators or boutique hotels usually provide receipts without GST information, which are not eligible for claim.

Supplier defaults: Even big travel suppliers sometimes default on filing returns, leaving SMEs vulnerable when the ITC doesn't reflect in GSTR-2B.

Blending business with personal travel: When an employee mixes personal days in a business trip, ITC can be claimed only proportionately, if at all.

Missed or late filings: Small finance teams with competing priorities often miss the tight ITC window, causing irreversible cost leakage.

Making Compliance a Strategic Lever

Visionary SMEs are integrating GST guardrails into their travel and expense (T&E) functions:

- Expense platforms now automatically scan invoices for GST compliance prior to submission

- Policy templates mandate employees to include GST-compliant invoices when claiming

- Leadership dashboards monitor ITC claimed versus missed, making tax recovery transparent

Why It Matters

For an SME that spends even ₹50 lakh a year on business travel, missing out on 8-10% of available ITC could translate to ₹4-5 lakh lost working capital per annum. For a scaling business, that's not only a compliance lacuna, it's money that can be reinvested in growth, talent, or digitalization.

GST on business travel is not merely about paperwork. It is about changing mindset from reactive compliance to proactive cash flow management. SMEs that get this right are not merely audit-ready but also more competitive in industries where every percentage point of margin is critical.

State-Wise Registration, HSN/SAC Codes & Documentation

GST is a location-based tax, so the state where your employee will consume the service decides the tax credit. There's complexity here: SMEs whose businesses travel to several states might require extra state GST registrations in order to offset ITC fully. Several lose credits due to just the fact that their business isn't registered in the state of travel.

Outside of registration, HSN/SAC codes are essential, they classify travel expenses such as flights, hotels, and auto rentals. Incorrect codes will result in denied ITC claims upon audit. Likewise, incomplete invoices - lack of GSTIN, place of supply, or invoice number - can jeopardize credits.

SMEs can remain audit-ready by:

- Collaborating with GST-approved travel agents only

- Requiring uniform invoice formats

- Storing a single repository of electronic invoices for a minimum 6 years

GST compliance is not merely about checking boxes. It's about creating audit-ready systems that safeguard your ITC and avoid surprises.

Scaling Business Travel as You Grow

A 2025 Business Travel Management Service Market Report predicts the worldwide market will expand from $8.58 billion in 2025 to $10.91 billion by 2029, citing increasing demand for end-to-end travel programs that include multi-office coordination and standardized policies designed to maximize spend and employee experience.

For early-stage SMEs, business travel often starts small - one office, a few frequent fliers, and ad-hoc bookings managed by email or WhatsApp. But as the business scales, so do the complexities of corporate travel. Suddenly, you are coordinating across multiple offices, regions, and functions, with employees, sales teams, and even external consultants all on the move.

Multi-office alignment: When offices are dispersed geographically, disintegrated travel booking results in duplicate expenses, disparate supplier rates, and uneven travel policies. A unified system guarantees visibility and standardization.

Team, vendor, and partner travel: SMEs fail to account for the cost of travel for vendors, contractors, and channel partners. In the absence of an integrated process, these expenses are not monitored, resulting in leakage on both spend and compliance.

Culture and employee experience: Scaling is not merely about cost savings. Standardized policy, frictionless reimbursement, and negotiated rates also drive a superior employee experience, supporting professional culture.

Corporate travel, at scale, is a strategic growth driver. Acquiring clients tend to involve face-to-face interaction, expanding into new markets means mobility for teams, and investors require governance-level processes. Organizations who view travel as a key growth driver, not an operational issue, open the doors to speed and control.

Selecting a Travel Partner: What SMEs Need to Consider

As SMEs expand, the question moves on from ‘how do we book travel?’ to ‘who do we trust to handle it for us?’ Selecting the ideal travel partner can be the difference between reactive firefighting and policy-led, scalable travel management.

Self-booking tools vs. agents vs. platforms

Traditional agents: Provide customized service but lack transparency and scalability. Reservations are subject to personal availability, and data visibility is restricted.

Basic self-booking tools: Inexpensive and simple to implement, but absence of policy enforcement, GST adherence, and integration with expenditure administration - suitable for startups, restrictive for SMEs.

Tech-powered platforms: The middle way that balances self-booking ease with policy guardrails, GST-readiness, contracted rates, and expense reconciliations. They offer scalability and governance without much internal investment.

Travel partner checklist for SMEs:

Policy enforcement - Does the application mark out-of-policy bookings in real time?

GST-readiness - Are invoices GST-ready, with HSN/SAC codes and state-level place-of-supply accuracy?

Visibility - Can the leadership view spend by department, project, or client in real time?

Integration - Does it integrate with accounting, HRMS, or ERP applications?

Flexibility - Will it not only deal with employee travel but also partner/vendor travel?

Scalability - Will the platform continue to function when the company expands from 50 to 500 employees?

For SME leaders, the ideal travel companion is more than about booking speed, it's about preparing the company's travel and expense infrastructure for the future. It's a decision that has implications for compliance, cash flow, employee experience, and ultimately, competitiveness in the marketplace.

FAQ

1. What is business travel management for SMEs?

It’s the process SMEs use to plan, book, and control employee travel. SME travel management ensures cost savings, GST compliance, and smooth employee experiences through clear policies and digital tools.

2. How can SMEs reduce travel costs while ensuring compliance?

SMEs save by booking in advance, negotiating vendor rates, and using travel expense management tools. Compliance is achieved with GST-ready invoices, policy checks, and real-time expense tracking.

3. Can SMEs claim Input Tax Credit (ITC) on flights and hotels?

Yes. SMEs can claim ITC on GST-charged flights, hotels, and cabs if invoices have correct GST details and HSN/SAC codes. Proper travel expense management helps maximize these credits.

4. What tools help small businesses manage travel and expense?

Digital SME travel management platforms integrate bookings, approvals, and reimbursements. They offer real-time tracking, policy guardrails, and GST compliance for high ROI business travel.

5. How do I create a business travel policy for my SME?

Define booking channels, approval flows, reimbursement timelines, and GST documentation needs. A smart corporate travel management strategy balances cost savings with employee flexibility.

Disha Chatterjee

Senior Content MarketerIn this article

1.Introduction

2.Why Business Travel Matters for Growing SMEs

3.T&E Spend within the SME Context

4.How to Create a Working Travel Budget

5.Per Diem vs Actuals: What's Right for You?

6.How to Reduce Travel Expenses Without Compromising Quality

7.Creating a Travel Policy for Your SME

8.Best Practices for Approvals, Reimbursements, & Visibility Expense Management for SMEs: Manual vs Automated

9.GST for Business Travel: SMEs Must Know

10.State-Wise Registration, HSN/SAC Codes & Documentation

11.Scaling Business Travel as You Grow

12.Selecting a Travel Partner: What SMEs Need to Consider

13.FAQ