GST on Business Travel, A Guide for Corporates and SMEs

On average, Indian enterprises experience a 7 to 8 percent drop in profits because of missed ITC claims (source).

Dealing with Goods and Services Tax (GST) for business travel can be challenging for businesses of any size. With proper knowledge and procedures, business companies can utilize GST bills from business travel to claim Input Tax Credit (ITC) and reduce travel expenses. Understanding GST on travelling expenses and how it applies to business trips is essential to avoid losing legitimate credits and to enhance cost efficiency. Let's dive into the details of how GST impacts corporate travel expenses, ensuring compliance, and avoiding the loss of valuable credits.

Managing GST in Business Travel

Corporate travel GST management remains a challenge for most companies in India. As part of broader corporate travel management efforts, invoicing reconciliations and tax reversals continue to put pressure on finance teams, who must juggle compliance and cost savings. For many organizations, managing GST on travel expenses efficiently can directly affect the company’s bottom line.

The GST, which was implemented in 2017, was expected to harmonize India's indirect tax framework by unifying many taxes into a single framework. Perhaps one of its most beneficial aspects for businesses is the ITC process, which enables firms to offset taxes incurred on business expenses against their output tax liability. But with no strategic approach, organizations stand to lose out on genuine credits. Problems such as inconsistent documentation, vendor non-compliance, and employee lack of awareness tend to result in financial losses. A lack of clarity on GST for travelling expenses or travelling expenses GST input can lead to missed opportunities for reclaiming tax credits.

Basics of GST on Business Travel

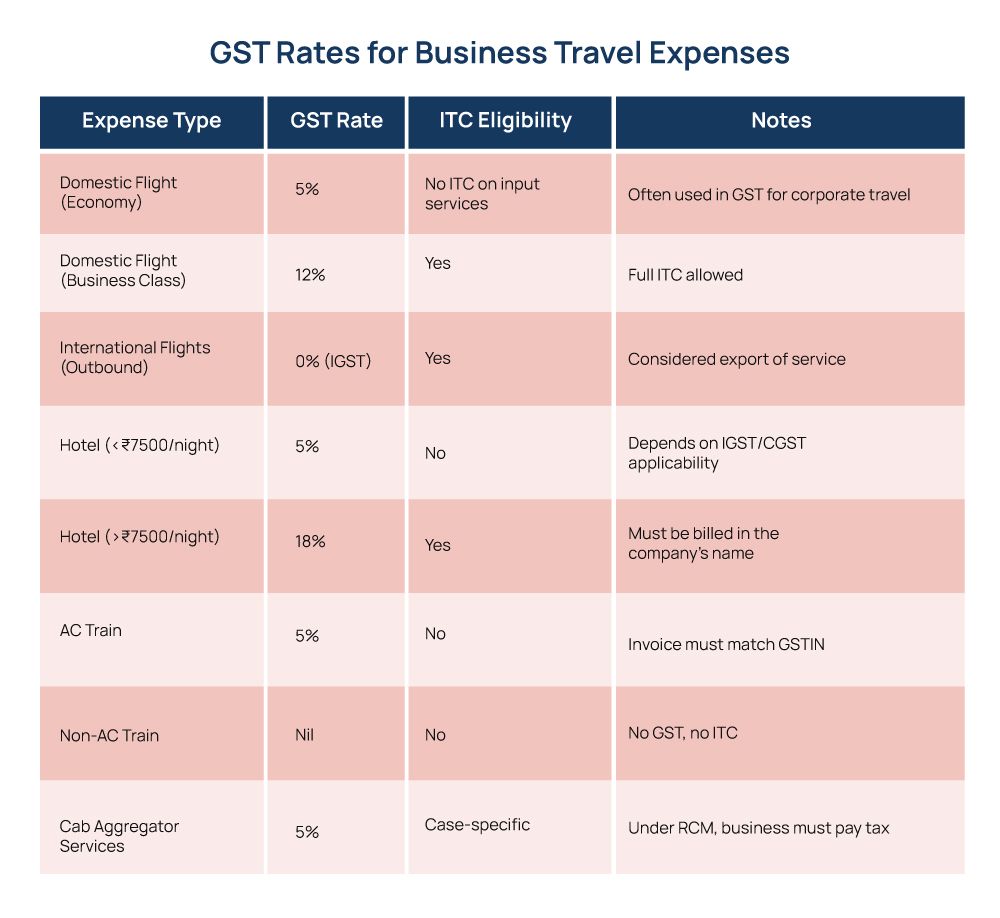

Business travel comprises several services, such as air and rail travel, hotel accommodations, food, cab fares, booking conference rooms, and agent commission, all with varying GST regulations (source).

Airlines: Domestic economy class tickets carry 5% GST without ITC, whereas business class tickets are charged 12% with ITC

Hotels: Room tariffs less than ₹7500 per night attract 5% GST; above ₹7500, it's 18%. Businesses should also note GST on hotel booking by agent may have different tax applicability depending on whether the agent passes GST through or absorbs it.

Trains: AC classes are subject to 5% GST; non-AC classes are not

Cabs: Rides through aggregators typically attract 5% GST in reverse charge in certain instances

To avail GST on business travel costs, companies require invoices with GSTINs of both parties, HSN/SAC codes***, correct tax split, and place of supply. Without proper documentation, organizations may not be able to reclaim GST on business travel or take GST input on travelling expenses. If these are not fulfilled, GST bills for business travel could not be eligible for credit, resulting in reversals or loss of money.

Maximizing Input Tax Credit on Business Travel

Making the most out of ITC claims is through adherence to both legal and operational best practices:

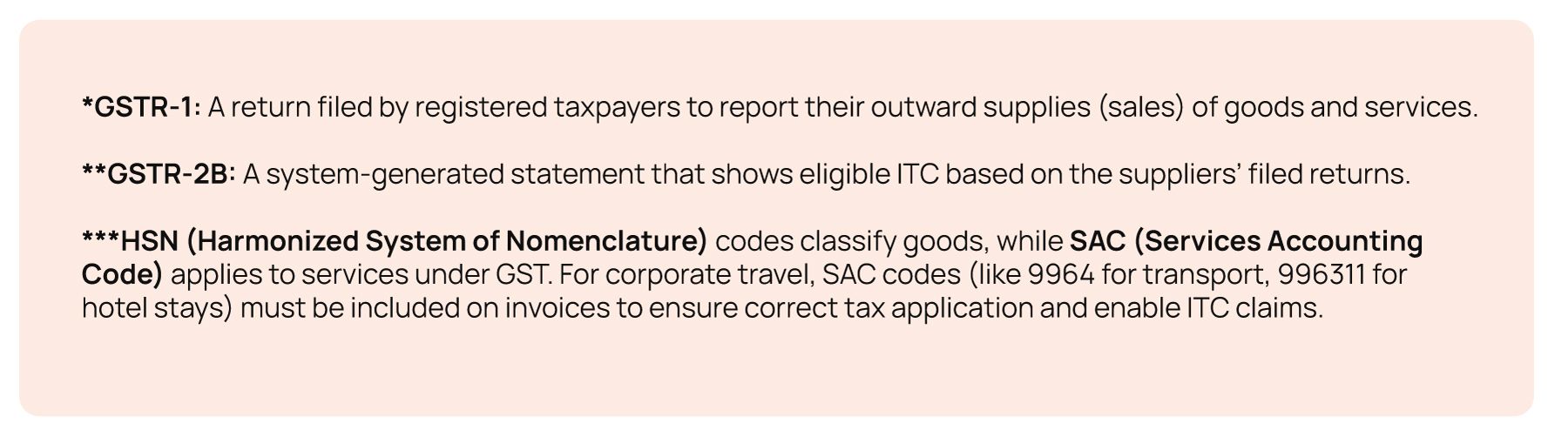

Conditions for Claiming ITC (source):

- The service should be for business use

- The invoice should have GSTIN, HSN/SAC, and tax segregation

- The vendor should submit their GSTR-1* return

- Reconciliation needs to be aligned with the company's GSTR-2B** data

This applies equally when considering ITC on travelling expenses for business, where valid GST invoices and vendor compliance play a crucial role.

Common Pitfalls:

- Booking via personal apps

- Incorrect invoice formats

- Late vendor filings

- GSTIN mismatch with the state of consumption

Solutions:

- Use GST-enabled booking tools

- Maintain a digital audit trail

- Educate employees to source valid GST bills for corporate travel

Many businesses also wonder - can we claim ITC on business travelling expenses or can ITC be claimed on travelling expenses? The answer is yes, if all eligibility criteria are met, and the expenses are incurred strictly for business purposes.

Challenges and Solutions for Corporates and SMEs

While GST is likely to have positive impacts on corporate travel, companies are challenged by numerous issues that restrict them from efficiently claiming input tax credit. These challenges are especially pertinent in the case of SMEs and fast-growing companies with mounting business travel.

Some important challenges are:

Vendor Reliability - A valid GST bill for a business trip is helpful only if the vendor files GSTR-1 correctly and on time. Many hotels, local cab vendors, or small travel agencies may provide GST-compliant invoices but fail to include them in their returns. This disrupts compliance, causing the transaction not to show in your GSTR-2B and making the credit ineligible.

Employee Conduct - Employees tend to make travel bookings through personal apps or select vendors that are not on the approved list. In such instances, invoices may be sent to the employee rather than the company or may not contain GSTIN, tax details, or HSN/SAC code numbers. Without documentation, corporate travel GST cannot be availed.

State Registration Inconsistency - GST is a destination-based tax, and input tax credit (ITC) can be availed only if your business has a GST registration (GSTIN) within the state of consumption of the service. Most businesses, particularly SMEs, have a few major locations but send employees all over the nation for meetings, client work, or events. With no state-specific GSTIN, even GST-compliant bills that are generated in such a state can result in ITC loss.

This raises a common question among smaller companies - how can SMEs manage multi-state GST compliance? The answer lies in using centralized travel and expense management tools that automate state-wise GST tracking and vendor reconciliation.

Common Use Cases

- Transit Travel - An employee makes a journey from Mumbai to Chennai with an overnight halt at Bengaluru. The hotel expenditure in Bengaluru, if the company is not registered in Karnataka, is ineligible for ITC despite the business trip.

- Multi-City Sales or Project Work - Field force, consultants, or client servicing personnel working from state to state might book repeat local services such as hotels or cabs across states where the company is not registered, resulting in cumulative ITC loss.

Manual Tracking - Most businesses are still employing Excel sheets, emails, and paper invoices to track GST bills for business travel. It can lead to missing invoices, inaccurate entries, late reconciliations, and mis-matching of transactions in GSTR-2B. Manual systems also make it difficult to track trends or patterns for missed credits.

Gaps between Departments - Admin or HR generally books while Finance takes care of tax compliance. If these departments are not coordinated, vital information like GSTINs, purpose codes, or state of supply is likely to be missed. This absence of data exchange results in incomplete audit trails and unredeemed credits against legitimate expenses.

In such cases, the inability to take GST input on travelling expenses or to handle reimbursement of travel expenses GST correctly results in direct financial leakage.

A few scalable solutions:

Have a Centralized Travel and Expense (T&E) Management Platform: Select a platform that not only books but also captures GST information automatically, verifies vendor compliance, and connects directly with your ERP/accounting system. This eliminates the dependence on dispersed processes and ensures GST bills for business travel are digitized, labeled, and connected to appropriate cost centers.

Create Booking Approval Processes: Define strict hierarchies that involve a GST compliance verification prior to booking approval. For instance, automatically block non-GST suppliers or mark entries without GSTINs on booking. This eliminates mistakes at the outset and reduces reconciliation time.

Arrange Periodic Employee Training: Organize quarterly GST awareness programs for employees engaged in traveling. Show examples of valid and invalid GST invoices, how vendor GSTIN can be verified, and the benefits of on-time submission of documents. Highlight the association of policy compliance and reimbursement authorization.

Develop and Implement GST Audit Checklists: Finance teams must perform quarterly (or monthly) audits based on a standard checklist. This can include checks on GSTR-2B reconciliation, invoice field validation, duplicate entries, vendor return status, and unreconciled expenses marked for reversal.

IGST Invoicing & Strategic GSTIN Expansion: Where possible, ask your vendors to provide IGST (Integrated GST) invoices to your registered office. This can be accommodated by some national chain hotels and aggregators. In case of frequent travel to specific states obtain GST registration in the respective states to allow maximum credit recovery.

Utilize a Real-Time GST Compliance Dashboard: Implement dashboards that offer visibility into:

- Vendor GSTR-1 filing status

- Invoice mismatch trends

- Missing GST fields

- ITC claimed against eligible amounts on corporate business travel expenses

These technologies enable companies to operate proactively instead of reactively.

Best Practices for Streamlined GST Management

To develop an enduring and compliant GST approach to corporate travel, companies need to integrate best practices within their finance and travel operations.

- Mandate Invoice Submission Policies: No GST bill, no reimbursement. Incorporate this rule into your reimbursement procedure. Ensure that employees upload invoices within a certain time limit and establish what makes a GST invoice valid (vendor GSTIN, HSN/SAC, address, etc.).

- Have a Whitelisted List of Vendors: Restrict bookings only to pre-approved vendors who continue to file GST returns on a regular basis. Evaluate vendor performance quarterly and exclude those who are below par in terms of compliance. Using GST-compliant vendors also reduces audit risks and enhances credit predictability.

- Automate Invoice Validation and GST Tagging: Use OCR-based tools or invoice processors that automatically read, extract, and validate GST fields from uploaded bills. These highlight discrepancies such as erroneous GSTINs, inappropriate HSN codes, or taxation mismatch, reducing human errors.

- Register in Frequent Travel States: If your staff frequently travels to certain cities or states, it makes sense to register for a GSTIN in such states. This provides access to local ITC (CGST + SGST) instead of exclusive access to IGST, which might not always be applicable or claimable.

- Perform Regular Reconciliations: Bi-weekly or monthly reconciliation with GSTR-2B helps you catch mismatches on time. Create a calendar and take responsibility for reconciliation, such as specific workflows for reporting non-compliant vendors.

- Create a Centralized Digital Repository: All bills must be kept in a well-organized, searchable repository with metadata such as trip ID, employee name, vendor, GSTIN, bill number, and state. This makes the company ready for GST audits and facilitates real-time expense analysis.

- Consult Experts for Special Situations: GST treatment is not always simple. Package services (such as hotel and meals), travel reimbursements, or services from overseas suppliers tend to raise questions. Periodic consultation with tax specialists can safeguard your ITC status and prevent penalties.

These best practices not only ensure compliance but also help reclaim ITC on travelling expenses of directors and senior management when incurred for legitimate business activities.

Why GST Compliance Is Important to Corporate Travel Planning

Travel planning is more than logistical; it's a compliance issue. Every GST invoice for corporate travel impacts the tax recoverability of the company. Poor invoice trails or vendor non-compliance directly impacts working capital and compliance scores. Effective management of GST on traveling is now seen as a financial control measure rather than just an accounting requirement.

How SMEs Can Streamline GST for Corporate Travel

For small and medium-sized business (SME), the challenge typically is striking the balance between effective functioning and high standards of compliance. Using digital tools simplifies reimbursement of travel expenses GST processing and makes ITC on travelling expenses for business claims seamless. Large organizations might have specialized tax groups or built-in platforms, but SMEs too can efficiently handle GST on business travel with these simple steps:

Use T&E Tools with GST Auto-Capture Functionality: Implement a business travel and expense management software that captures and verifies GST information from uploaded bills automatically. Such tools ensure that all GST bills incurred for business travel are recorded digitally. This eliminates errors in manual entry and makes it simpler to label expenses against corresponding GSTINs and projects.

Pre-Negotiate with GST-Compliant Suppliers: Prior to engaging vendors such as hotels, cab operators, or travel agencies, ensure that they give GST-compliant invoices and file GSTR-1 returns on a regular basis. Prepare a basic checklist to screen suppliers or ask for a compliance certificate. This helps avoid non-compliant partners that could invalidate ITC claims on corporate travel expenses GST.

Train Employees on Invoice Collection and Upload: Employee conduct is usually the weakest component of GST compliance. SMEs need to have short yet efficient training programs that address:

- What is a valid GST bill

- Red flags to avoid, such as incorrect GSTIN, omission of HSN codes

- Schedules for submitting invoices upon return from travel

This helps inculcate a compliance-first culture and enhances correctness of claims.

Outsource GST Reconciliation to Professionals: If the in-house finance team is small, outsource GST reconciliation for travel expenses to a tax consultant or managed services provider. They assist with:

- Matching invoices with GSTR-2B data

- Detecting ineligible claims

- Preparing reports for monthly filings

This minimizes the lost credits or notices for compliance from the tax authorities.

Track Travel Expenditure via Dashboards: Install easy-to-use dashboards, even Excel-based ones, that monitor business travel GST expenditure, reconciliation status, vendor compliance ratio, and credit recovery patterns. Visual aids help SME founders or finance heads better manage compliance without having to dig through multiple complicated spreadsheets.

By implementing these steps, SMEs can convert GST into a saving tool rather than a compliance headache.

One key question is, how can SMEs manage multi-state GST compliance? The answer lies in using cloud-based travel and expense platforms that automatically track GST across all states, ensuring eligible GST input on travelling expenses is accurately captured and claimed.

TripGain simplifies this process with a travel and expense management platform that is GST aware. This facilitates every eligible credit being accessed by SMEs without increased effort. Whether the question is, ‘can ITC be claimed on travelling expenses’ or ‘how to handle GST on travel expenses for inter-state travel’, TripGain ensures compliance and visibility at every step. Corporate expense for GST-related travel becomes quantifiable and controllable part of the business when bookings are planned, accounts are made digital, and reconciliation is done on time.

Final Thoughts

GST for business travel isn't merely tax regulations, it's smart financial planning. Companies that implement GST in their travel policy are better placed to save on costs, avoid compliance issues, and remain audit-proof. By proactively managing GST for travelling expenses and automating reconciliation, businesses can easily reclaim GST on travelling expenses while maintaining audit readiness. With proper tools, training, and vendor alignment, organizations can transform corporate travel costs GST from a liability into a tax-maximized asset.

FAQs

1. Is GST payable on all business travel expenditure in India?

GST is payable on most business travel services such as flights, hotels, taxis, and food. Non-AC railway fare is exempt.

2. Do we need to get separate GST registration in all the states our employees visit?

No, but for intrastate services such as hotel nights, one needs to have a GSTIN in the stateto claim ITC.

3. May my company claim ITC for all business travel expenditures?

Yes, if the service is for business purposes, the invoice is in the company's name, and the vendor submits their GST returns.

4. How long does a company have to claim ITC for business travel expenditures?

Claim ITC by the earlier of: September of the next financial year or annual return filing date.

5. Is international travel expense eligible for ITC?

Typically not. Services booked from Indian vendors, however, may be eligible for ITC based on circumstances.

6. Can one claim ITC if the travel GST invoice is in the employee's name, not company name?

No. The bill should be in the name of the company with proper GSTIN.

7. Are the expenses on meals incurred during business travel allowed as ITC?

Generally no, except if meals are included in an aggregate package such as a hotel deal.

8. What can my company do if a travel supplier fails to issue a GST-invoice?

Request a GST-compliant invoice. Where not available, do not use that supplier again.

9. How is GST taxing on employee travel allowances as opposed to reimbursements?

Allowances (e.g., per diem) are not subject to GST or ITC. Reimbursements might be taxable if accompanied by valid GST invoices.

Disha Chatterjee

Senior Content MarketerIn this article

1.Managing GST in Business Travel

2.Basics of GST on Business Travel

3.Maximizing Input Tax Credit on Business Travel

4.Challenges and Solutions for Corporates and SMEs

5.Best Practices for Streamlined GST Management

6.Why GST Compliance Is Important to Corporate Travel Planning

7.How SMEs Can Streamline GST for Corporate Travel

8.Final Thoughts

9. FAQs