Why Enterprise Travel Tools Must Integrate with ERP, HRMS, and Finance Systems

For many large enterprises, the business of business travel starts with a simple idea - get employees from point A to point B, manage their expenses, and reconcile it all at month-end. But as organizations grow, multiple business units, global travel, hybrid workforces, complex regulatory environments, such as the underlying systems that support travel and expense (T&E) management, can become a liability rather than an asset. What once worked with spreadsheets, emails, and stand-alone tools quickly breaks under volume, complexity, and scrutiny.

At the heart of this challenge is system fragmentation. Travel booking platforms, HR tools, accounting systems, and Enterprise Resource Planning (ERP) platforms often operate in silos. Without strong integration, data flows stop at the boundaries of these systems, forcing finance, HR, and travel operations teams into time-heavy, error-prone manual work. In contrast, enterprises that integrate travel tools with ERP, Human Resource Management Systems (HRMS), and finance systems unlock deep visibility, faster processes, stronger compliance, and richer strategic insights across departments.

The Visibility Challenge in Enterprise Travel

In any large enterprise, visibility isn’t a luxury, it’s a business imperative. CFOs and financial controllers need a single source of truth to manage forecasts, budget planning, cashflow, and compliance. When travel and expense data remain isolated in a separate system, finance teams often learn about critical expenses weeks after employees have traveled. This not only delays financial reconciliation, it obscures real-time spending trends and undermines strategic decision-making.

Integrated travel and expense platforms feed travel spend directly into core financial systems, giving finance and travel leaders live insights rather than month-end guesses. This level of transparency helps prevent budget overruns and enables enterprises to respond quickly to macro shifts, whether that’s a sudden surge in corporate travel demand or cost pressures building across operations.

Industry research shows that integrating travel and expense systems with core enterprise platforms is a key driver of efficiency and control in large organizations. A global study by Amadeus and Forrester Consulting found that improving travel and expense management is a priority for 73% of enterprises, with integration across ERP, HRMS, and finance systems identified as critical enablers.

Why ERP Integration Matters - From Entries to Enterprise Control

ERP systems serve as the backbone of financial accounting in large organizations. They are where the general ledger lives, where auditing trails are maintained, and where budgets are operationalized across departments. When travel tools talk directly to the ERP, every airfare, hotel stay, meal, and incidental expense can be coded, categorized, and reconciled in real time.

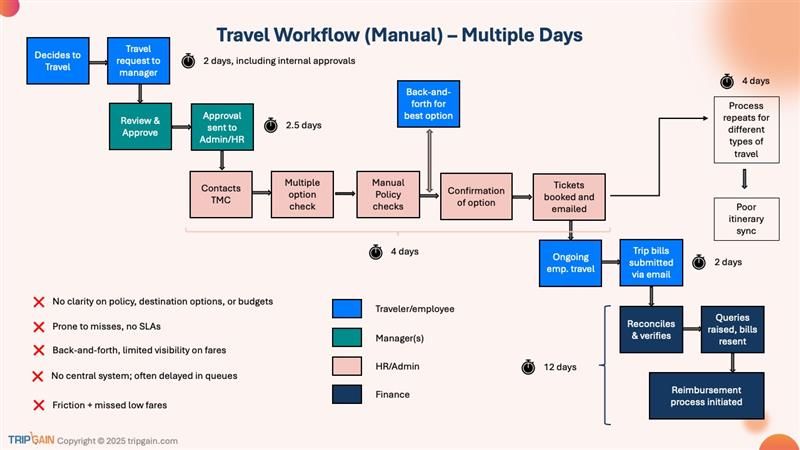

Automated Workflow: Without this integration, travel expenses often require manual data entry into the ERP, a labor-intensive task that increases risk of error and delays financial close cycles. By automating this flow of data, enterprises not only reduce administrative overhead but also strengthen compliance and audit readiness.

Transparent Financial Insight: ERP integration makes travel expenses part of the core financial narrative rather than a disconnected silo. With travel spend visible in profit and loss reports, variance analyses, and forecasts, finance teams can validate costs against approved budgets, enforce controls, and maintain audit trails without manual work. Industry research shows that only about 52% of enterprises globally have fully integrated travel and expense systems, and where integration exists, organizations see faster close cycles and more accurate financial reporting, turning travel data into governed, actionable financial insight.

HRMS Integration - Aligning Travel with People Data and Policy

An enterprise travel policy is not just a document, it is a governance mechanism tied to roles, hierarchies, and spend entitlements. Yet, despite most organizations having formal policies, nearly 70% still enforce them manually, relying on emails and spreadsheets that slow approvals and increase compliance risk. When travel and expense systems are not integrated with HRMS, approval rules based on job grade, cost center, or reporting structure must be updated manually, leading to delays, exceptions, and policy leakage.

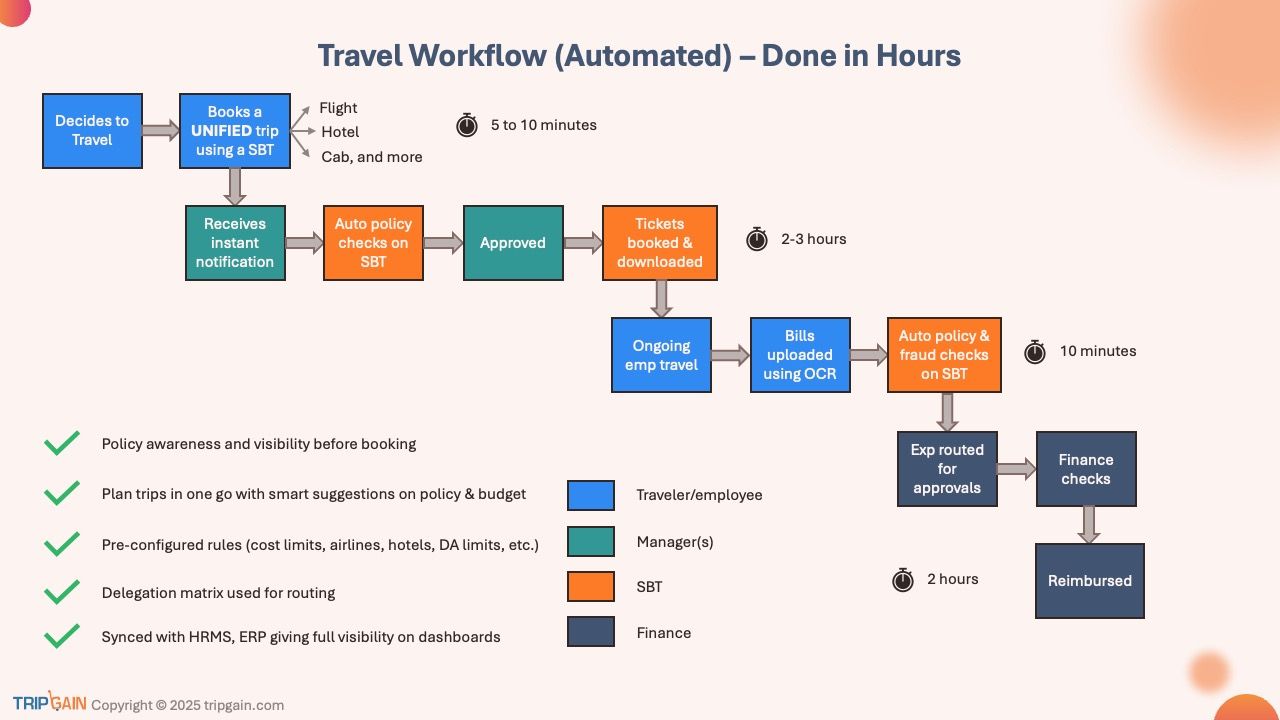

HRMS integration changes this dynamic by allowing employee profiles, approver hierarchies, and cost centers to flow automatically into travel workflows. Integrated systems enable automated policy enforcement before expenses are incurred, rather than corrective checks after submission.

According to industry analysis, automation and system integration can reduce the time employees spend on expense reporting by up to 80% and accelerate reimbursements by 2-4 times, while significantly reducing data errors and administrative effort. As a result, policy compliance improves not through tighter policing, but through smarter system design.

Finance Systems - Speed, Accuracy, and Cost Control

Travel transactions don’t end once the employee returns home, that’s when the real accounting work begins. Expense reimbursements must be issued, mischarges resolved, advances reconciled, and year-end reports prepared. All of these activities involve finance systems like accounts payable, general ledger, and payroll.

When travel tools are disconnected from finance systems, reimbursements can take weeks to process, errors can slip into payables, and finance teams spend a disproportionate amount of time on clerical tasks rather than strategy. Integrated finance workflows allow travel expense data to be validated, categorized, and routed directly into accounts payable and payroll. This means faster reimbursements for employees, higher satisfaction, and fewer out-of-pocket situations.

Risk Control and Compliance: Finance systems can immediately flag out-of-policy expenses, duplicates, or unusual travel spend patterns for review long before month-end. This real-time monitoring strengthens compliance with internal controls and external financial regulations.

Accurate Cost Forecasting: Rather than waiting for expense reports to trickle in, finance teams can model future travel cost scenarios, adjust forecasts based on actual spend patterns, and factor travel costs into quarterly planning with confidence.

The Operational and Employee Experience Benefits

Integration doesn’t just save time for travel and finance teams, it enhances employee experience. Disconnected systems often force employees to enter the same data multiple times across travel bookings, receipts, expense forms, cost center codes, and reimbursement requests, increasing both effort and the risk of errors or delays.

By contrast, integrated travel and expense platforms automate repetitive tasks and pre-fill data from HR and finance systems, reducing manual entry and minimizing mistakes. According to a 2025 market analysis by Stats Market Research, organizations using automated and integrated T&E solutions report 40-50% faster expense report processing and significantly shorter reimbursement cycles. Employees can upload receipts that automatically link to trips, view pre-filled forms, and receive faster reimbursements. In India’s mobile-first workforce, this ease of use, especially on smartphones, drives higher adoption rates, fewer manual submissions, and stronger travel policy compliance, turning T&E platforms from administrative burdens into intuitive, employee-friendly tools.

Adoption and Integration Challenges

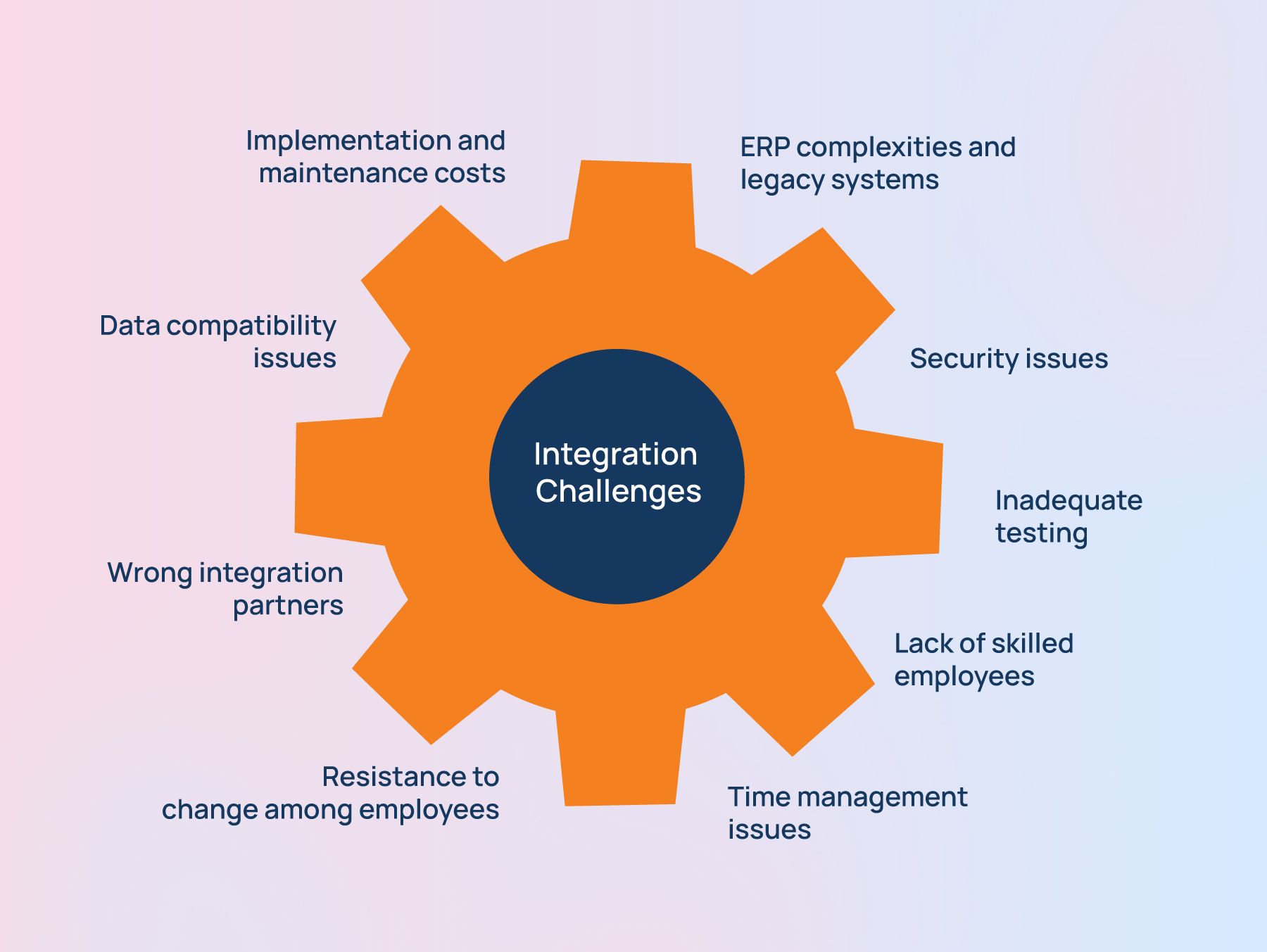

Despite the clear benefits, many enterprises still struggle with integration. While the global travel and expense management software market reached USD 3.3 billion in 2024 and is projected to grow to USD 5.6 billion by 2032, much of this growth is driven by organizations trying to move away from fragmented, disconnected systems (source). In practice, many enterprises continue to operate with travel tools that are only partially integrated or not integrated at all with ERP, HRMS, and finance platforms, limiting automation and real-time visibility.

These gaps are not just technical issues but organizational barriers that impact productivity, compliance, and employee confidence. Enterprises that invest in tighter integration gain stronger spend visibility, higher policy adherence, and greater leverage in budgeting and vendor negotiations, turning travel data into a governed, decision-ready asset rather than an operational afterthought.

Integration as an Enterprise Imperative

For large enterprises, travel management must evolve from a stand-alone operational function to a connected enterprise capability. Integrating travel tools with ERP, HRMS, and finance systems isn’t just about reducing manual work, it’s about creating a finance-ready, people-aware, policy-enforced flow of data that supports strategic decisions.

When travel data becomes part of the enterprise digital core rather than a peripheral silo, organizations gain:

- Real-time visibility into spend and compliance

- Faster, more accurate financial close cycles

- Automated policy enforcement and fewer exceptions

- Better employee experience with faster reimbursements

- Deeper insights for forecasting, negotiation, and planning

In an era where financial agility and operational clarity matter more than ever, enterprises that unify travel with their broader systems win not just efficiency, they gain a competitive edge in how they manage costs, people, and growth.

FAQ

1. Why is ERP integration important for enterprise travel and expense management?

ERP integration ensures travel spend is recorded in real time, improving financial control, reporting accuracy, and audit readiness.

2. How does HRMS integration improve travel policy compliance?

HRMS integration automatically applies role-based policies and approval workflows, reducing manual errors and policy violations.

3. What issues arise from disconnected travel and expense systems?

Disconnected systems cause duplicate data entry, delayed reimbursements, limited visibility, and higher compliance risk.

4. How does integrated travel and expense management improve employee experience?

Integration reduces manual effort and speeds up approvals and reimbursements, driving higher adoption and satisfaction.

5. Is integrated travel and expense management becoming standard for enterprises?

Yes, enterprises are increasingly adopting integrated, cloud-based platforms to improve governance, efficiency, and scalability.

Disha Chatterjee

Senior Content MarketerIn this article

1.The Visibility Challenge in Enterprise Travel

2.Why ERP Integration Matters - From Entries to Enterprise Control

3.HRMS Integration - Aligning Travel with People Data and Policy

4.Finance Systems - Speed, Accuracy, and Cost Control

5.The Operational and Employee Experience Benefits

6.Adoption and Integration Challenges

7.Integration as an Enterprise Imperative

8.FAQ