The Silent Budget Killer: 7 Expense Frauds Slipping Past Your Finance Team (And Why AI Is the Only Way to Stop Them)

The most sophisticated heist in corporate history isn't happening in a bank vault. It's happening right now, in your inbox, buried inside a mundane PDF labeled "Oct_Expenses.pdf."

It’s subtle. It’s boring. And it is costing your company a fortune.

While you are focused on Q4 projections, a "client dinner" that was actually a family birthday party just slipped through approval. A duplicate flight receipt from three months ago was just reimbursed again. The expense reports piling up on your finance controller's desk aren't just administrative clutter—they are a minefield of potential revenue leakage.

Welcome to the messy reality of expense fraud. It is rarely dramatic, often unintentional, but always expensive. According to the Association of Certified Fraud Examiners (ACFE), organizations lose an estimated 5% of their annual revenue to fraud, with asset misappropriation being the most common scheme.

The harsh truth? Excel spreadsheets and tired human eyes cannot catch these patterns. Here are the 7 types of fraud currently bleeding your budget—and how AI-driven expense management acts as the unblinking auditor that stops them.

1. The Phantom Receipt (Ghost Expenses)

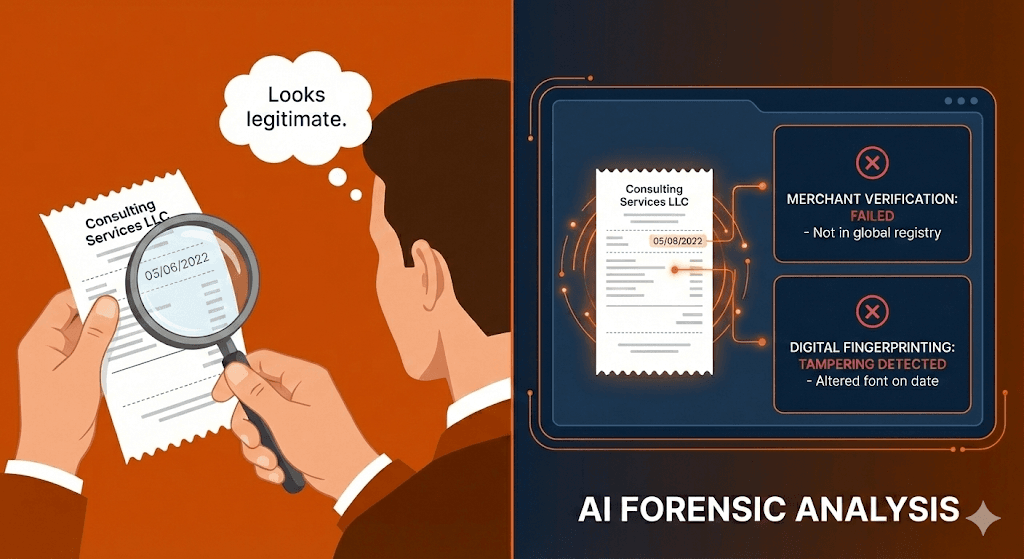

The Scheme: This is the boldest move in the book. An employee submits a receipt for a transaction that never happened. In the past, this meant dumpster diving for discarded receipts. Today, it’s digital: using graphic design tools to fabricate an invoice or recycling a PDF receipt from six months ago with a modified date.

Why Humans Miss It: If the font looks professional and the math adds up, a human auditor assumes it's real. They rarely have the time to Google every vendor ID or cross-reference the merchant’s existence during manual auditing.

The AI Advantage: AI doesn't just read the total; it performs forensic analysis.

- Merchant Verification: It checks global business registries to ensure "Consulting Services LLC" is a real, registered entity.

- Digital Fingerprinting: Advanced OCR (Optical Character Recognition) can detect if a font on the date line is slightly different from the rest of the receipt—a tell-tale sign of Photoshop tampering.

2. The "Double Dip" (Duplicate Submissions)

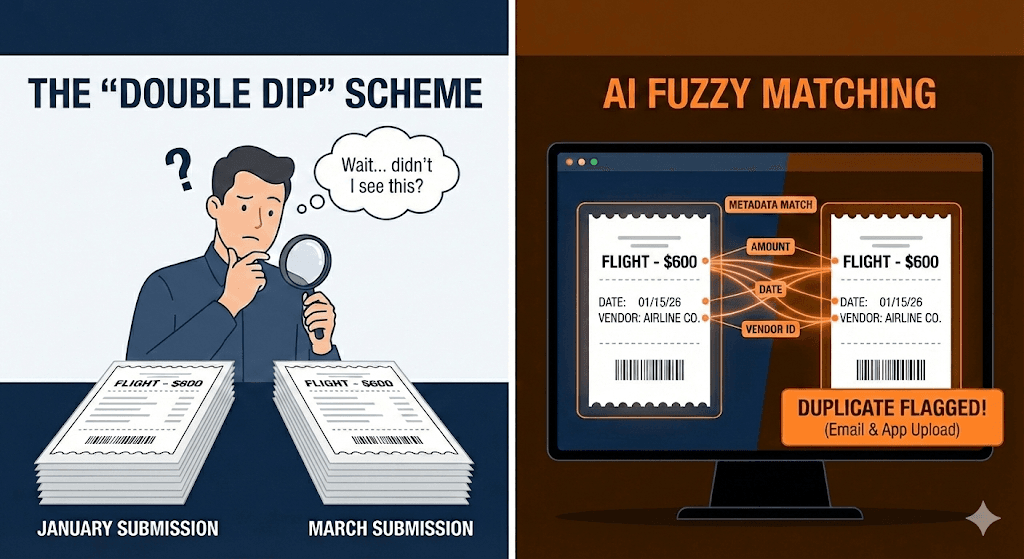

The Scheme: An employee books a flight for $600. They submit the receipt in January. In March, they submit the same receipt again, perhaps cropped slightly differently, or buried in a bundle of 50 other items. Sometimes it’s accidental; often, it isn’t.

Why Humans Miss It: Human memory is short. An auditor cannot remember a specific hotel bill from 60 days ago. Without a perfect memory of every line item ever submitted, duplicates slip through easily.

The AI Advantage: TripGain’s AI utilizes fuzzy matching logic. It doesn’t just look for identical filenames; it compares metadata—amount, date, vendor, and transaction ID—across time. It recognizes that a receipt submitted via email and a receipt photo uploaded to the app are the same transaction, instantly flagging the duplicate.

3. The “Round-Up” Tax (Inflated Expenses)

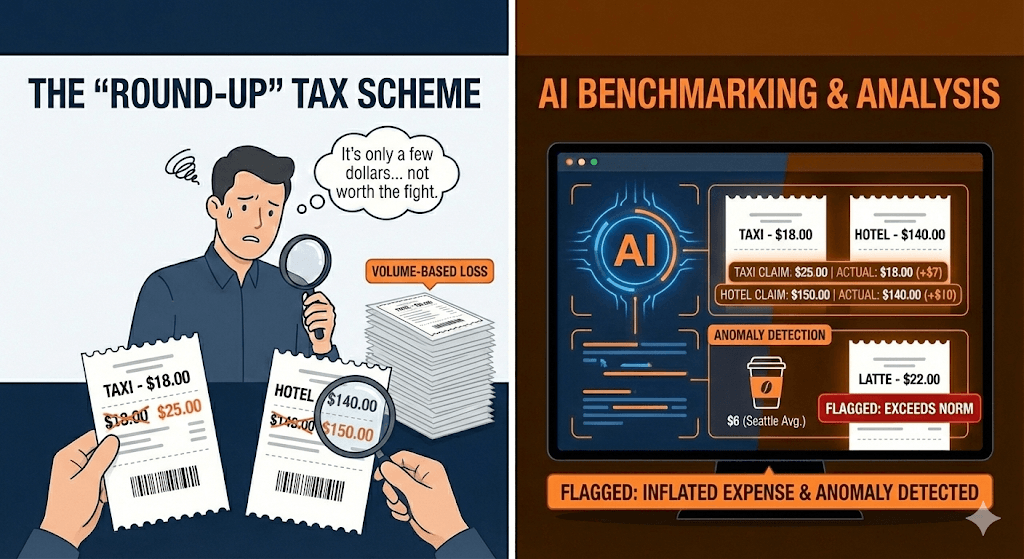

The Scheme: The taxi ride was $18. The expense report says $25. The hotel was $140; the claim is $150. These micro-frauds seem insignificant individually, but they are volume-based. Across a 500-person company, these $10 inflations can amount to a six-figure loss annually.

Why Humans Miss It: It’s the “pick your battles” psychology. An auditor sees a $7 discrepancy and thinks, “Is it worth the email chain to fight this?” Usually, the answer is no.

The AI Advantage: AI has no social anxiety. It reads the handwritten tip on a receipt and compares it to the claimed total. It also utilizes benchmarking data: if a standard coffee in Seattle is $6, and an employee claims $22 for a latte, the system flags the anomaly based on geographic pricing norms.

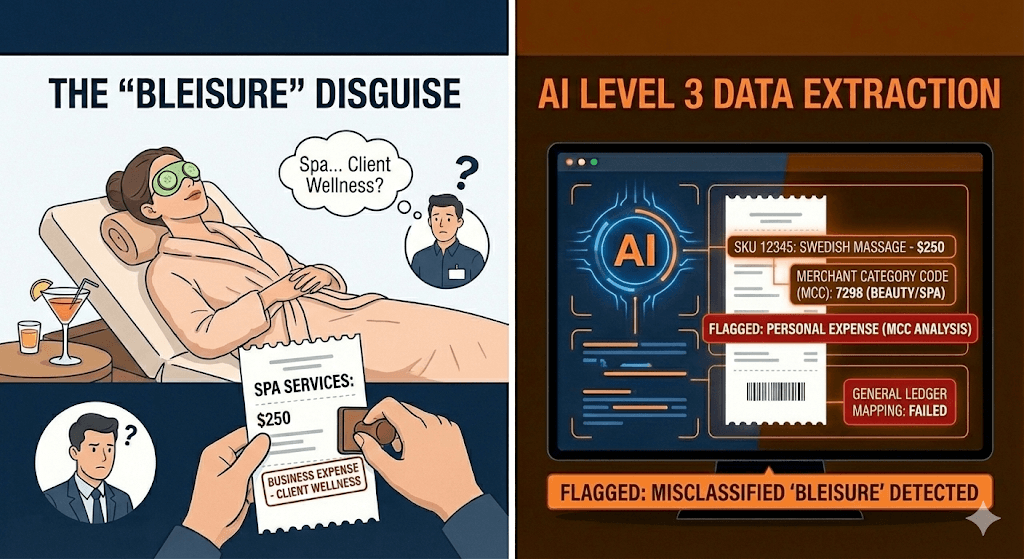

4. The “Bleisure” Disguise (Personal Misclassification)

The Scheme: "Bleisure" (Business + Leisure) is on the rise. This fraud occurs when personal indulgences are creatively labeled as business needs. That spa massage? "Client wellness." The upgrade to first-class for a spouse? "Travel fees."

Why Humans Miss It: Context is hard to decipher. If an employee lists "Target" as the vendor, was it office supplies or groceries? Without seeing the itemized SKU list, auditors often default to trust.

The AI Advantage: Modern AI employs Level 3 Data extraction. It reads the line items, not just the merchant name. It knows that a "Swedish Massage" SKU does not map to "Client Entertainment" in the general ledger. It also analyzes Merchant Category Codes (MCC) to flag high-risk vendors (e.g., casinos, jewelry stores) instantly.

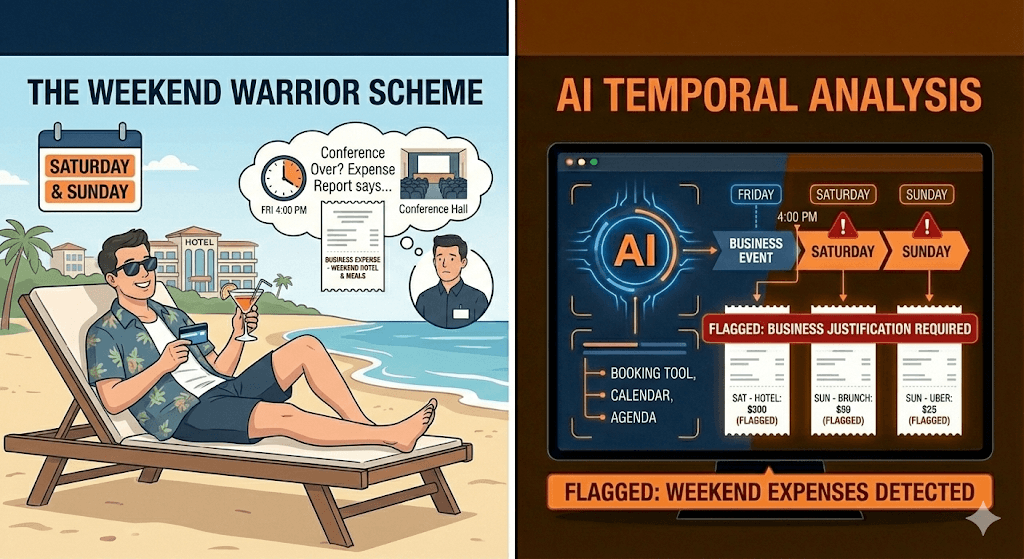

5. The Weekend Warrior

The Scheme: An employee travels for a conference that ends at 4:00 PM on Friday. They fly home Monday morning. The hotel, meals, and Ubers for Saturday and Sunday are expensed as "business travel," despite the conference being over.

Why Humans Miss It: To catch this, an auditor needs to cross-reference the expense report against the conference agenda, the flight itinerary, and the company calendar. It’s a logistical nightmare that rarely happens in manual corporate travel management.

The AI Advantage: Temporal analysis. The AI integrates with travel booking tools and calendars. It sees the conference ended Friday. It flags every transaction made on Saturday and Sunday, asking: "Business justification required."

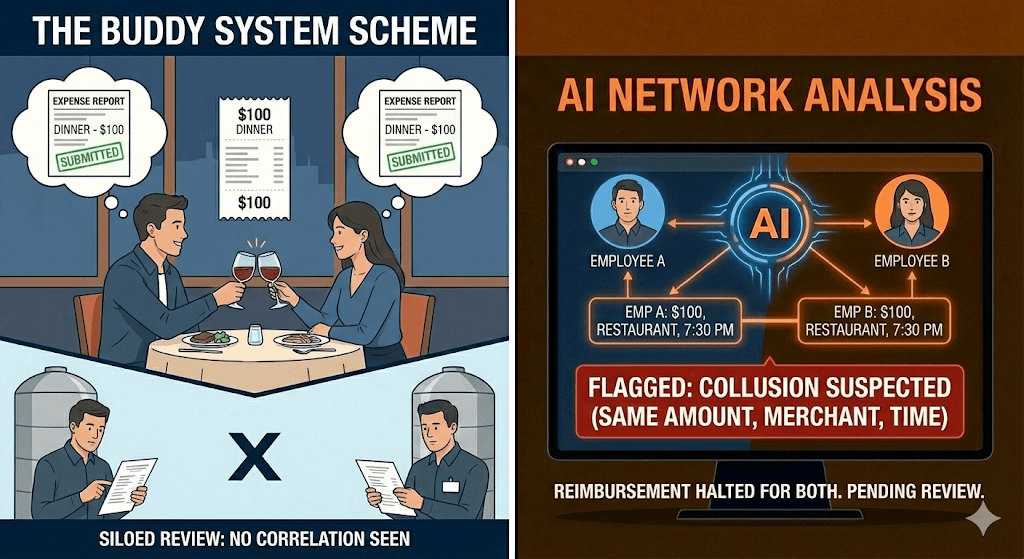

6. The Buddy System (Collusion)

The Scheme: Two employees go to dinner. The bill is $100. Employee A expenses it. Employee B also expenses it. Or worse, they split the bill on two cards but both claim the full amount.

Why Humans Miss It: Most audit workflows are siloed by employee. The auditor reviewing John’s report isn't looking at Sarah’s report at the same time. They have no way of seeing the correlation.

The AI Advantage: AI looks at the entire network. It identifies clusters of spending. If two employees submit receipts for the exact same amount, at the same restaurant, at the same timestamp, the system connects the dots and halts reimbursement for both pending review.

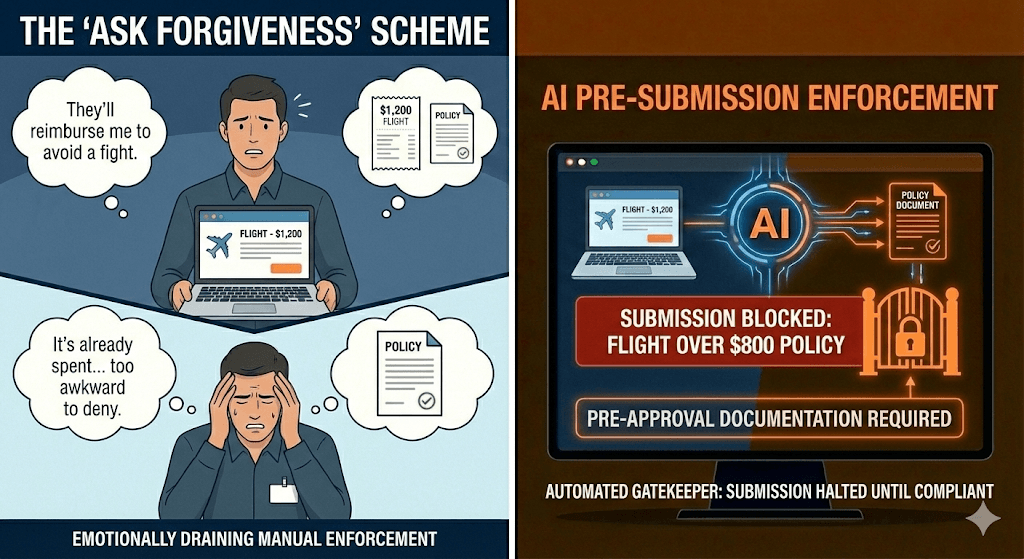

7. The "Ask Forgiveness, Not Permission" (Policy Violations)

The Scheme: Your policy says flights over $800 need pre-approval. An employee books a $1,200 seat and claims, "I didn't know," or "It was an emergency." They bet on the fact that once the money is spent, the company will reimburse them rather than having an awkward confrontation.

Why Humans Miss It: Enforcing policy exceptions is emotionally draining and time-consuming.

The AI Advantage: Pre-submission enforcement. Best-in-class AI tools can flag this before the expense is even submitted. It acts as a gatekeeper, cross-referencing the claim against the specific policy document and blocking the submission until the required pre-approval documentation is attached.

The ROI of Automating Trust

According to a study by Oversight Systems, organizations that automate expense audits can detect 2% to 5% of T&E spend as high-risk or fraudulent.

If you are relying on sample-based manual audits (checking every 10th report), you are essentially leaving your back door unlocked.

AI doesn't sleep. It doesn't get "audit fatigue." And it doesn't play favorites.

By moving to TripGain AI-driven expense system, you aren't just catching fraud; you are freeing your finance team from the role of "bad cop." They stop chasing receipts and start analyzing data, while the software ensures that the only money leaving your business is money that helps it grow.

Ready to close the leak? It’s time to stop looking at receipts and start looking at solutions.

Contact us today!

Godi Yeshaswi

Senior Product MarketerIn this article

1.The Phantom Receipt (Ghost Expenses)

2.The "Double Dip" (Duplicate Submissions)

3.The “Round-Up” Tax (Inflated Expenses)

4.The “Bleisure” Disguise (Personal Misclassification)

5.The Weekend Warrior

6.The Buddy System (Collusion)

7.The "Ask Forgiveness, Not Permission" (Policy Violations)