In many workplaces, employees often have to travel for work, as a part of their role. Some companies try to make it easier by giving employees a company vehicle or by reimbursing them for every mile they travel in their vehicle depending upon the company’s travel policy. While the employee claims for reimbursement of a particular amount of mileage, it is upon the Finance team to arrive at the most precise and optimal mileage eligible for the places traveled by the employee and to reimburse the amount claimed by employees. Usually, this may not sound like a pain point for a travel from point A to point B, however, the complexity and chances of disagreement arise when this turns into a Multi-stop Mileage claim. It is often tedious and time-consuming for the approver to calculate the optimal and most precise mileage eligibility. To solve this problem, there is TripGain’s Multi-stop mileage solution for rescue, which reduces ambiguity and disagreement, while saving significant effort and time of the approver. To understand its relevance, we will see some use cases in general.

Let’s talk about the scenarios for employee Mileage Reimbursement claims in an organization.

- Going to multiple client’s locations.

- Driving for trade shows, and seminars.

- Heading to the airport or train station for a work trip.

- Any travel that an employee role demands.

What are the challenges faced by Approver and employees with Multi- stop Mileage Reimbursement?

Let’s suppose that Rahul is an employee who is a sales representative. He has to visit multiple locations in Bangalore by his own vehicle. He has to start from the office and travel for a trade show in MG Road and after that, he has to go for a client meeting in Hebbal and Bellandur and return to office. Now, Rahul has to file for his mileage reimbursement. He has to check his Odometer reading and cross-check by calculating the distance manually like Office to MG Road then MG Road to Hebbal and so on and submit for expenses for reimbursement. This entire process becomes time-consuming and complicated.

On the other hand, the approver has to manually check the mileage through Google Maps for the given number of stops and whether the employee has taken the optimal route or not. This entire process is time-consuming and there could be chances of conflict.

How does the multi-stop Mileage feature works?

The Multi-stop Mileage feature is designed to meticulously track instances where employees utilize their personal vehicles for business-related endeavors. Its capabilities extend to monitoring crucial details such as distance traveled and odometer readings, enabling precise calculation of the reimbursement amount owed to employees. Moreover, this software seamlessly integrates with an expense management system, facilitating the comprehensive tracking of multi-stop expense reports submitted by employees.

Benefits of using Multi-stop Mileage Reimbursement Software:

Enhanced Data Accuracy and Integrity: The use of a specialized system ensures precise management of mileage expenses, elevating the reliability of your data.

Time and Cost Savings: By automating the mileage tracking process, the system efficiently saves both time and money. Employees typically input starting and final odometer readings after completing a business trip.

Preventing duplicity: Unlike manual systems, where mileage readings can be easily inflated, automated software helps curb expense fraud. This is crucial as exaggerating and falsifying claims are common issues that can be challenging to verify without the aid of automation.

Increased Visibility and Insight: Adopting automated mileage tracking software provides immediate visibility and insight into mileage expenses. This transparency enhances the reimbursement process and prevents additional costs associated with mileage fraud.

Use TripGain software to calculate multi-stop mileage expense

A high-quality multi-stop expense management solution will automatically compute the mileage reimbursement rate based on your organization’s expense policy. Suppose, Rahul has to travel for multiple client meetings in one day within Bangalore and he wants to claim the travel expense. To simplify the claim process, he can choose mileage expense option and follow the below process:

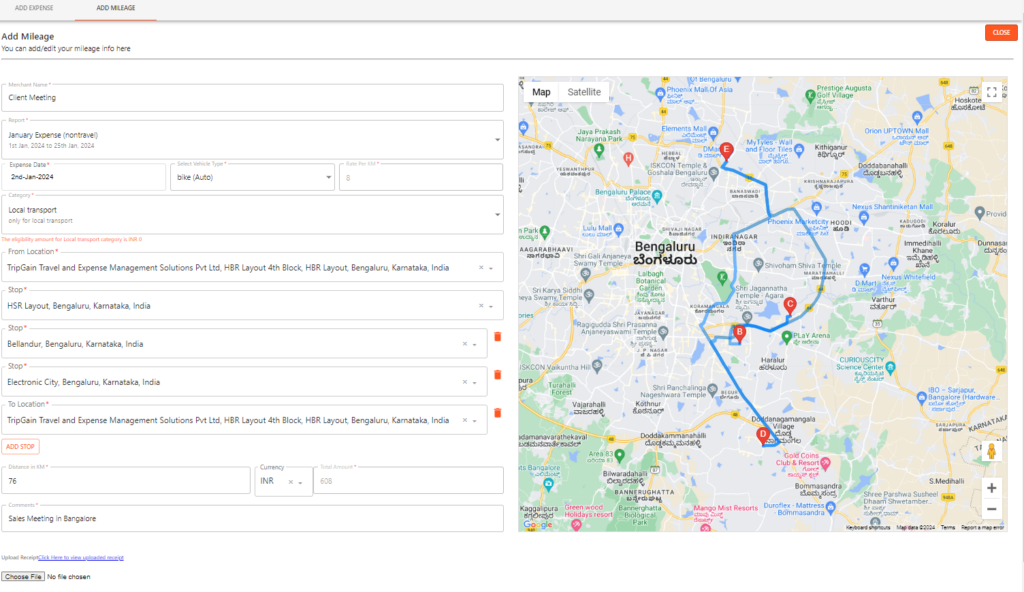

1.Enter the merchant name ‘Client meeting’ and Select the report name, ‘January Expense’ from the report repository.

2.Select the expense incurred date from thecalendar.

3.Select the Vehicle type as ‘Bike’.

4.The system will automatically fetch the Rate Per KM based on the configuration.

5.Select the vehicle number and category as ‘Local transport’.

6.Enter the from location as TripGain office ‘BMR Complex’.

7.Since he plans to visit multiple client locations in a day he can add the first stop as ‘HSR Layout’, the second stop ‘Bellandur’, the third stop as ‘Electronic city’, and the final destination as TripGain office ‘BMR Complex’.

8.TripGain application will automatically calculate the entire distance traveled by Rahul in a single day.

9.The system will automatically generate the total amount reimbursable for a particular travel done by Rahul and he can submit the report.

Therefore, this entire process can be simplified with TripGain’s Multi-stop Mileage feature which helps in authenticating the expense submitted and overall, it saves time and cost. There is also a provision for variations or deviations to accommodate any unpredictable factors like the traffic, road works, forcing the employee to deviate from the route. The calculation has an option to add a variation buffer of an x% which can be chosen by the company as per their policy.

To automate the entire Travel and Expense process, choose TripGain today. Explore Now